So you Want To Launch A Brand? Why You Should Start Now

I started writing an article showing the steps and timeline for creating a new food and beverage brand. I wrote more than I expected so I decided to post the article in bite size pieces here on a bi-weekly basis.

The pandemic, amongst other things, has caused many entrepreneurs to pause and re-think their strategy. Many entrepreneurs who have great new food and beverage ideas are waiting to see what happens. I can say, that is a very bad strategy for entrepreneurs because while they wait, others will be moving forward and will be the first to gain shelf space when the country goes back to our new normal.

Let’s look at a typical timeline for a new food or beverage item. For arguments sake, let say you already have an idea in your head. What do you do next?

Research and Development

Let’s start with research and development. You might be able to create your product in your kitchen today but it will be much difficult once you move to the production phase. For a very basic example, let’s say you are using Heinz ketchup as an ingredient. If you were to order Heinz ketchup in a 50-gallon drum, the minimum size you can usually order for a production run, it would be very expensive. Depending on how much you use, Heinz Ketchup may make your product too expensive to sell or too expensive to make a profit. Heinz ketchup has a certain taste profile. When you move into production you will most probably need to buy a less expensive but high-quality ketchup. Where do you go for that? How do you sample the different types of ketchup being sold in bulk? Will the manufactures send you free samples if you are a startup?

This all leads up to you probably should hire a person or company, like Parkside Beverage, Beyond Brands, or Metabrand amongst other reputable firms. Get your recipe or formula done right the first time. In the grand scheme of things their fees are not a lot of money and you need to get it right the first time. Re-formulating takes time and money.

I have been on the floor of production facilities with clients who created their own recipes and were trying to adjust the formula on a fly. It was a disaster. I remember one time being on the production line when someone’s formula would not work because the ingredients were too thick and they were clogging the filters. That costs a lot of money. The client had to pay for the entire day of production even though he/she was never actually able to produce their product. My advice, stick with the professionals and they will save you a lot of money in the long run.

Now let’s look at the timing and timeline. Formulation companies aren’t waiting for new entrepreneurs to contact them. Even during these Covid 19 times, reputable formulation companies are still busy. They point is you can’t just pick up the phone and expect them to get started immediately. It might take two weeks until they can accept your business. It might take them time to order special ingredients.

Once they create the first batch of samples for you, and I am sure this will not be the last batch of samples, and you consider the time it takes for them to mail you the samples, and the time it takes for you to review the samples and send comments back to the formulator, and they eventually finalize the formula, consider 4 more weeks go by.

Now you have your formula. Great start. Do you want it to be GMO free? Organic? Kosher? These processes take time and someone has to fill out all the paperwork and get all the information for the certifier. My last go around with a GMO-Free certifier took 6 months because they are backed up. However, let’s say it takes 3 months. However, assume you can work on other parts of your product during that time period.

Shelf Testing

Let’s consider the next step being Shelf Testing. Before you produce your product, you want to know what happens to your product after being exposed to different levels of heat, cold, light, etc. Are any bacteria growing? What about yeast, pH, mold, salmonella, E. Coli, listeria, staph, aureus etc.? How long will your product be on the shelf before the color or taste or aroma begin to change? And this isn’t just a “nice to have”. Retailers and Distributors may request to see the shelf life test results.

According to RL Food Testing Lab, Product Safety Testing will take different times depending on the type of item you are testing.

Here are a few examples:

- Beef Jerky 9 months – 1 year

- BBQ Sauces 4 months – 6 months

- Pasteurized Dairy Products: 3 weeks

- Raw Juices 5 days

- Cakes, Cookies & Other Bakery Goods WITH preservatives 30 days

- Salsa 3 months – 4 months

But now, you need to test for shelf life. How long will your product last before going bad or before losing taste, aroma or even color?

The rule of thumb regarding shelf life testing, depending on the product, is that a product needs 1 week of testing for every month of shelf life you are looking for. But, that timeline may be a little bit over cautious. For the sake of this article, let’s say it takes you 90-120 days until you get your test results.

Cascadia Managing Brands is a strategy, brand management and sales execution firm that helps startups succeed. In this bi-weekly series Bill Sipper, Managing partner, shares his insights on:

Product Formulation

Certifications & Testing

Future articles will discuss:

Brand Positioning and Logo and Label Development

Intellectual Property and FDA Compliance

Point of Sale Material and Presentation

Liability Insurance

Distribution Strategy

Sales Execution

Overall Timeline

The Great Recycling Con Job?

We are all today brought up with the belief that recycling is important. Experts, people of power, and organizations constantly tell us that recycling is vital if we want to ‘save the planet.’ However, the reality is far more complex, and there’s a lot more to it than you might think.

First of all, when we’re environmentally conscious, we are not only saving the planet, we are saving ourselves. It’s presumptuous to think that any of our individual actions can destroy or save the planet on a global level. We are just one living organism among a whole host of living organisms on Earth that has occupied it for millions of years. They all came and went, and the planet is still here. We are a mere second in the entire existence of the world.

In essence, all the bad we do to the planet will only lead to our own extinction, and the Earth will continue to exist long after our demise.

But besides the fact that we are not saving the planet when we recycle, we are also not really recycling. At least not in the way we are told. You want to know why? It’s a long story, but by the end of this post, you’ll know the real truth about recycling – the one no one will tell you.

Before we begin, you have to understand how recycling works in this day and age. Let’s begin:

How Recycling Works

Recycling has been around for long enough that the very word has come to symbolize one thing – turning something that is no longer useful anymore into something new instead of throwing it away. But how does the recycling process work exactly?

We, regular citizens, throw our recyclable waste into the eponymous blue bin instead of the regular garbage can. A recycling truck comes and picks up the recyclable waste we throw away. The truck then takes the garbage to the recycling plant. There, a very complicated process happens through which all of that garbage is turned into raw materials that can then be turned into something completely new.

Naturally, the process is not endless. Every recyclable product is usually down-cycled, which means that the new product can never be the same as the original. For example, when old newspapers are recycled, the paper will still contain residue ink, and the fibers within the paper will be much shorter and weaker. For that reason, the recycled material won’t be as desirable for the same product, but it can still be used for something else. The same thing happens with most other products. And after a couple of rounds through the recycling processes, the material will reach a point where it will no longer be usable. So, returning to our example of paper, after it’s been recycled repeatedly, the paper will no longer be usable and can only be discarded.

However, that doesn’t mean that some products can’t be up-cycled, because they can. By being smart, we can turn certain products into even better ones. For example, one could make a whole furniture piece out of old plastic or aluminum cans and a bunch of newspapers. Even old wood can be reused to create something new and equally beautiful. However, in the majority of cases, products are only down-cycled and eventually become unusable.

So, is that the truth about recycling? Well, yes, but there is still more to it. This is just a lesser-known fact about recycling, but there is still the big truth that will completely alter your opinion on recycling.

What the Companies Don’t Want You to Know About Recycling

As it turns out, there is a lot that companies aren’t saying. It’s as if they are covering up the big truth, or several of them. The biggest one is the fact that not all plastic is recyclable. This is important because the biggest polluter among the waste we create is plastic. The main reason for this is the amount of plastic we create and how long it takes for it to decompose.

For example, it takes only two weeks for paper to decompose, which is why paper garbage is not a big problem in the world. The real problem is the amount of trees we chop down to make it. But I digress. Organic waste decomposes fairly quickly as well, from a few weeks to a couple of months. The real problem is the materials that take very long to decompose. For instance, nylon fabric takes up to 40 years to decompose, while rubber takes as much as 80 years.

But all of these relatively common products are nothing in comparison to plastic. It takes plastic a whopping 450 years to decompose! Once you take into account that plastic was invented in 1907, you quickly realize that none of the plastic that has ever been produced has decomposed by now. All of it is still here. And do you know how much of it? The latest study from 2017 states that 91% of all plastic never gets recycled. That’s around 8.3 billion metric tons of plastic, and all of it is now waste. What’s more, only 12% of all the plastic that has ever been made has been incinerated. The rest of it is polluting our land and the world’s oceans.

According to National Geographic, A whopping 91% of plastic isn’t recycled, even though we put them in those blue bins! Many mixed plastic and paper cartons (Tetra Pak for example) do not get recycled, contributing to 78 million tons of packaging waste in U.S. landfills as of 2015.

To an extent, this is our fault. But mostly, it is the fault of the brands that create plastic products. For example, Coca Cola has recently been named as the world’s biggest plastic polluter for 2019 – again. An audit that was conducted by Break Free From Plastic, an environmental justice group, has shown that Coca Cola makes 43% of all plastic waste. Nestle and then Pepsi follow Coca Cola as the world’s biggest plastic polluters.

The problem with all of this is that not even the previously mentioned 450-year mark is certain. We don’t know for sure how long it takes for plastic to decompose as none of it has existed long enough to decompose. Therefore, 450 years is just an estimate.

Now, most of us believe that we are doing good when we recycle plastic. So, in essence, if all of us were to start recycling, there will be no plastic waste in the world, right? Well, that’s very wrong. Remember what we said before? The part that mentioned that not all plastic is recyclable? We were talking about the plastic that’s put in the blue bins – the one that’s recyclable according to their label. As it turns out, out of the seven types of plastic that are ‘recyclable’, five of them hardly get recycled at all. According to the Environmental Protection Agency (EPA), out of all the plastic that was put up for recycling in 2017, only 8.4% of it was ultimately recycled. The other 91.6% went to the many landfills and into the ocean. The same report from the EPA states that, on average, 50% of all other waste is usually recycled. So yes, the biggest issue is plastic.

If you think this is already very bad, you will be surprised to know that it used to be better, at least for the United States. It seems that the US used to send about 20 million tons of garbage to China, and they were the ones who were supposed to deal with it. But in the end, they decided that they were not going to do our recycling for us. The same happened in the Philippines and Malaysia. As it turns out, these countries began to have their own environmental issues when it comes to waste. Now, many states or counties in the US don’t even have good recycling programs anymore because of this.

This brings us to the second big truth.

What the FTC Doesn’t Want You to Know About Recycling

The second big truth about recycling involves the FTC or the Federal Trade Commission. As you are probably already aware, most products we buy have that small green triangle symbol that denotes that the packaging is recyclable.

The FTC is the one that allows companies to put this symbol on their packaging. With that in mind, you would expect the commission to have some specific and strict rules which force the companies to create fully recyclable packaging. But alas, that’s as far from the truth as one could get.

The rules and guidelines set by the FTC are very complicated, so I won’t get into them as I don’t even understand them entirely. But what I do get and what it all boils down to is that companies can find many loopholes and vague rules that allow them to put the little triangular symbol on almost anything. And what ends up happening is that a significant portion of the products that boast that symbol still don’t get recycled in the end.

The best example of this is the famous Tetra Pak packaging that’s widely used across the globe, not just in America. As it turns out, Tetra Pak is not as recyclable as we are led to believe. According to the regulations set by the FTC, it is recyclable, but according to common sense, it’s not. That’s because the process used to recycle Tetra Pak is overly complicated and rarely used. Plus, parts of the Tetra Pak don’t get recycled. The result is that a lot of the Tetra Pak packages end up in landfills or the ocean as not all of it is recycled.

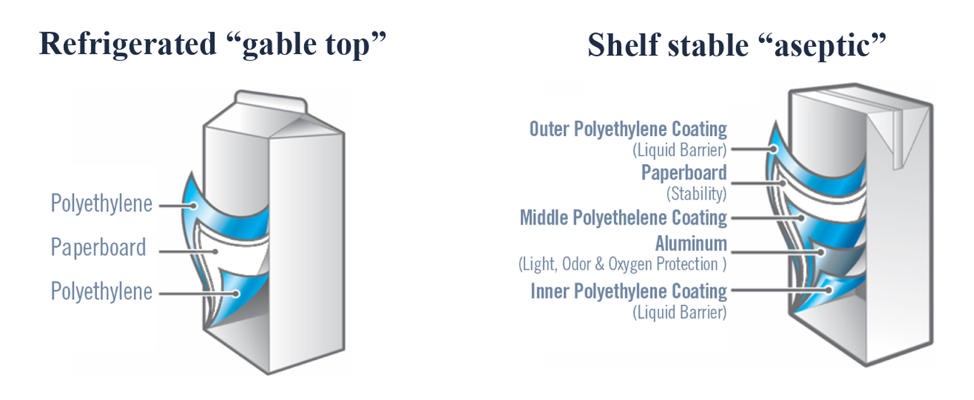

Paper, plastic, and aluminum are layered together to make cartons: A typical shelf-stable carton averages 74 percent paper, 22 percent plastic, and 4 percent aluminum. A familiar form of this packaging is unrefrigerated soup or wine cartons.

Refrigerated cartons skip the aluminum and usually contain an 80 percent paper and 20 percent plastic combination to hold in the liquid. The Carton Council of Canada provides extensive information about the composition of different types of cartons and their recyclability.

Source: Carton Council

Tetra Pak is just one example. Many other products are allowed to have recyclable labels on them, and yet they rarely end up being recycled. Even though that’s the case, the companies that create these products want us to believe that recycling is good and vital for us. By doing that, they keep us wanting to buy their products. Because for as long as we are incredibly eco-friendly, we will continue to purchase their products, knowing that what we throw them in the big blue bin will that will send them to the recycling plants. It’s a win-win situation, the companies make money, and we are all eco-friendly in the end. But, as you can see, we aren’t, not really.

So, if so much of the garbage we make ends up in a landfill or the ocean, is there even a point to recycling? Yes, there is.

Key Takeaways

Even though the big truth is that so little of what’s supposed to be recycled ends up being recycled, it’s still vital for us to keep recycling our waste. None of this changes the fact that a lot of the garbage we create ends up in the recycling plant. And even though a large portion of it doesn’t, that shouldn’t mean we should stop trying altogether. The little effort we make still means something. And it’s not like we can stop buying everything just because we know it might not get recycled.

What we really need is for the FTC to start making better rules. We need those guidelines to be stricter so that companies are forced to create products that will always end up recycled. We also need them to enforce real penalties and impose massive fees for those that don’t follow the guidelines.

However, we also need companies to start finding ways to deal with the plastic and other waste they create that ends up in the landfills and oceans. They are the ones causing the biggest problem with the waste crisis we have today.

We also need consumers to buy less plastic. Switch to cans and glass whenever you can. Almost everything you can buy in plastic is available in glass or cans. Ask your retailer to purchase more can and glass beverages. You have responsibility too.

I feel that the first step towards real change is for all of us to learn the whole truth. Once we do, we can start spreading it. The more people who know the truth and react to it, the more the government and the companies can work towards fixing the mess they created.

In the meantime, you should keep following my blog because more stories like this one are going to follow!

Retail & Grocery: Amazon.com, Inc.

In only 24 years, Amazon.com Inc. has evolved from a little online bookstore to the most extensive digital retailer in the world. Generating $177.9 billion in net sales from its over 300 million users in 2017, it is a giant in many markets, including retail and groceries.

As the company remains true to its four guiding principles – customer obsession rather than competitor focus, passion for invention, commitment to operational excellence, and long-term thinking – its sell-through position strengthened with inroads in new categories. Among other things, it has led Amazon to acquire Whole Foods Market as its subsidiary.

In 2018, the growth trend continues. Despite demanding more dollars for marketing from vendors, Amazon has met planned sales expectations for the second quarter for many categories (14 out of 25), exceeding plans in 9 categories in the changing natural food industry.

Orders from Whole Foods mainly surpassed its planned expectations due to deep discounts for Amazon Prime members, while higher marketing fees discouraged vendors from investing in promotion for their products. As a result, more vendors have opened Seller Central accounts, which allowed them to manage costs better and simplify product launch, and increased direct shipment from Prime Now.

Those are only two critical areas to watch. But if you want to learn more about other changes in 2018, there are other trends to look out for in retail and grocery as the year draws to an end at Amazon.

A Growing Amazon Prime Membership

In May 2018, the cost of Amazon Prime membership rose to $119. And while some vendors viewed it negatively, most don’t expect any significant impact on service use. It comes down to the advanced features included in the membership to its users, including Amazon’s marketing tools and expanded offering on Amazon.com platform. A natural food vendor even said:

“Amazon keeps offering more and more benefits [for Prime members], so I don’t think [the higher annual fee] will have any impact. Prime members value that service so much.”

And payment fees and commissions to Amazon were also raised in most vendor contracts. Because of the 10% increase in rates, all vendor contracts from 2017 are invalid, and sellers need to sign a new 2018 contract.

But it’s important to remember the terms in the new contract are negotiable. And while vendors do encounter additional fees, like fulfillment fees, inventory fees for storage, out-of-stock penalties, and accrual fees, it’s important to accept Amazon’s demands and negotiate a 2018 contract.

Amazon Competition Is Low

Amazon’s main competitors are Walmart.com and The Kroger Co., closely followed by Walmart’s Jet.com, Walmart brick-and-mortar stores, Target Corp. and Thrive Market Inc. However, most vendors agree that no e-commerce platform or store chain can compete with the retail giant when it comes to grocery retail.

However, Kroger and Target are making breakthroughs in grocery assortments and improving the shopping experience for their consumers. It seems to be generating interest among some vendors, as Kroger, for example, is placing standard category managers in charge of specific category managers and buyers. But it is yet to generate the amount of attention required to disrupt Amazon’s large-scale operation.

Amazon Prime Is Helping Whole Foods

Amazon’s Prime benefits (10% discount on all items and steep “Prime Member Deals”) helped increase sales during the second quarter in 2018 at Whole Foods Markets. The Amazon subsidiary saw an initial redemption rate between 60%-70% in June, but the figure is likely to reach 80% by year-end.

Prime Deals and promotion also aided vendors in their efforts. Many natural and organic vendors stated their Whole Food orders exceeded expectations, with almost all of them meeting their planned goals.

Despite this, vendors will bear the cost of those mandatory 10% discounts, which may result in several sellers reducing budgets allocated for promotion. However, for most of them, the price will be worth the effort if Amazon can deliver the right sales volume with Prime discounts. And according to the amount of sales Amazon made – it can.

Grocery Sales on Amazon.com and Fresh

In 2018, Amazon has made a lot of efforts to increase its foothold into groceries. It has led natural and organic food vendors to a very successful quarter with their sale of non-perishables on Amazon.com, than of perishable items sold on AmazonFresh. Also, over 65% of vendors exceeded planned order figures, which led some of them to improve their use of Amazon Marketing Services (AMS).

More and more vendors are turning to e-commerce SEO and search terms with AMS for marketing, than, for example, offering customer incentive programs such as coupons. On the other hand, vendor spending on ads has also increased but not significantly. Still, the combined efforts of both marketing tactics resulted in a higher revenue stream than in previous years.

In contrast, vendors who used AmazonFresh did not meet expectations. Their sales quotas fell below plan. They attribute this to significant reorganizations within the company, as AmazonFresh and Prime Now are hiring more staff in Seattle and distribution networks get realigned to handle perishable goods.

New Expansion Plans

Another critical factor influencing all of these changes is Amazon’s plan for rapid expansion. In short order, AmazonFresh is planned to move from the current eight-hour delivery format to a new two-hour delivery, which will make it stand out even more from the competition.

A new app is also set to be launched shortly, as Amazon wants to consolidate all of its grocery platforms in one place. But, until now, there is yet to be an integration of all purchases into one system, as Amazon.com, AmazonFresh, Prime Now, and Amazon Go remain separate from Whole Foods.

Finally, Amazon is moving towards direct shipments to reduce the reliance on United Natural Foods Inc. The plan is to allow room for rapid expansion of Prime Now with a hub-and-spoke system that will revamp warehouses and transportation logistics for perishables.

Follow Trends and News

Keep up to date with the latest innovations, trends, news, and so much more in the retail and food and beverage. Stay on top of best practices when it comes to marketing and sales, and gain insight from inside the industry.

With new developments each week, a piece of news, a new strategy or business model might catch your eye and lead you to apply it to your business to –

Seize the opportunity! Grow to scale! Realize the potential of your business! Become a leading influence on the market!

For more information about Cascadia Managing Brands, please go to www.cascadiamanagingbrands.com

Creating North America’s Premier Food Wholesaler

In June 2018, United Natural Foods (UNFI) and Supervalu decided to uproot North America’s wholesale distribution by combining their efforts to create a premier wholesale distributor. UNFI is the largest distributor of natural organic products in the United States and Canada, while Supervalu is the largest publicly traded wholesaler in the U.S.

Their joint enterprise indicates a rapidly changing infrastructure landscape in which consolidation among stakeholders in the supply chain is fast-becoming the new norm. And this has become a prime example of how manufacturers, suppliers, distributors, and retailers are pushing for change in Canada and the United States.

Based on this recent industry development, here are the most significant benefits of creating a premier food wholesaler in North America.

Adding Value to Customers and Stakeholders

Transforming into North America’s top wholesale food distributor is beneficial for all parties involved in the supply chain, including consumers and shareholders.

First off, it allows distributors to create a diversified consumer base. As they merge to form a common front, it automatically expands the consumer base to open up new opportunities to different stakeholders and increase distribution across all fronts. Delivering an extensive and comprehensive product offer to UNFI’s existing natural and organic products has allowed Supervalu to create a genuinely “better for you” offer.

As high-value products like organic meat and products become available to a broader audience, it enables cross-selling opportunities for different stakeholders on a much larger scale. A much more significant market across the United States and Canada gives wholesalers a much broader geographical location to work with and increase their market reach. The much more extensive scale has not only enabled growth but has improved their efficiency and effectiveness across the board.

The increase in capacity relies heavily on leveraging scalable systems. Focusing attention on streamlining larger operations has enabled different stakeholders to optimize their processes. Combined with the increased use of technology to achieve this goal has equipped all involved parties to meet customer expectations and reduce future expenses at the same time.

And in the case of UNFI and Supervalu, it also delivers significant synergy, which by the third year can create a run rate cost opportunity of more than $175 million.

Advanced Build-Out-The-Store Growth Strategy

With UNFI and Supervalu heading the enterprise, many smaller brands have joined the food super-wholesaler. Both giants contributed in equal measure in securing brands which create the supply chain. UNFI brought Blue Marble Brands, Woodstock Farms, Tumaro’s, Rising Moon, and Field Day to the fold, while Supervalu contributed with Essential Everyday, Culinary Circle, Market Centre, and Wild Harvest, among others.

Handing each brand a seat at the table has enabled them to have a united market presence, and create an advanced build-out-the-store growth model. The strategy is relatively simple and relies on increasing the product range to bring in attractive products to the store, and build a comprehensive and diversified product portfolio.

With each brand specializing in a specific food group, everyone is specializing in premier products. It expands the offer to the consumer, who is treated to a variety of quality, natural, organic, free-range, and specialty food items.

Complementary Contribution

Combining the two wholesalers into one has also merged their capabilities. It works because both UNFI and Supervalu share certain features. However, their most significant advantage is in the different and unique abilities, which essentially compliment one another.

UNFI’s revenue contribution is divided among Independent Natural Retailers (26%), Supermarkets (30%), Supernatural Retailers (33%), and other revenue (11%) such as e-commerce retailers and foodservice customers.

Supervalu’s revenue contribution is divided among Independent Regional Supermarkets (61%), Unified Groceries (29%), SVU FL (5%; regional chains, multi-stores, and single stores), and other (5%) which includes military and corporate revenue.

The combined revenue of UNFI and Supervalu is therefore divided among Independent Regional Supermarkets (48%), Unified Groceries (17%), Supernatural Retailers (14%), Independent Natural Retailers (11%), other revenue (8%), and revenue from SVU FL (3%).

It diversifies the consumer base for both wholesale retailers, as well as their revenue streams. In doing so, both UNFI and Supervalu can adapt to the fast growth of retailers and supply their demand for products.

A Compelling Opportunity

The opportunity for the premier food wholesaler will be to unlock the potential value across the business using synergy. Synergetic cooperation between the two organizations will improve the business process and inside operations, but also create a unified presence when dealing with outside services.

A combined effort has a more significant effect than individually either UNFI or Supervalu would have ever been able to achieve, and will benefit multiple aspects of the premier food wholesaler:

- Revenue – a diversified revenue stream from cross-selling, offering high-growth products in stores and expanding the private label offering (net sales expected to reach over $21 billion);

- Capital expenditure – increasing optimization of the supply chain and more effective capacities in distribution centers minimizes costs and expenditure (strong cash flow can reduce leverage and improve the credit profile);

- Systems and technology – combining IT systems and cyberinfrastructure of both companies will enhance automation and use of technology to streamline the business process;

- Operations – joint operations, increased capacity and a united strategy all increase efficiency inside the business model and stood to benefit everyone across the supply chain;

- SG&A (selling, general & administrative expenses) – increased capacity minimizes expenses especially by optimizing lease contracts and reducing fleet-related costs;

- Expanding Gross Margin – aligning strategies and methods of inbound logistics and adopting a professional service unit to monitor the process will help with larger capacity.

Ready to Learn More About the Food and Beverage Industry?

Stay up to date with the latest news and innovations in the food and beverage industry, and use what you learn to grow your business. It’s the best thing you can do for your brand, and all you have to do is realize the opportunity right in front of you to use its potential. Contact me or connect on twitter if you want to share with me your industry experience.

For more information about Cascadia Managing Brands go to www.cascadiamanagingbrands.com

The Current State of the Specialty Food Industry in 2018

Specialty foods are unique and highly valuable food items. Typically, this type of food is produced from small amounts of high-quality ingredients, which is the reason behind their above-average price tag, but also their overall quality and health benefits.

In 2018, The Specialty Food Association released a two-year study titled The State of the Specialty Food Industry. Author and researcher, Denise Purcell discovered significant changes in the food industry, with a focus on specialty foods. The study highlights the impact specialty foods have on sales and consumer decisions. Here is a brief overview of her findings and the current state of the specialty food industry.

Reasons Behind the Rise of Specialty Foods

Specialty foods might seem like a trend, but its roots span much deeper. Thanks to FDA regulations on labels and nutrition guidelines, more people are aware of the health risks involved with food and beverages. Ingredient labels help people to understand what they eat and drink, and watch out for ingredients like sugar, artificial flavoring, or chemical food dies, to improve health.

Consumer demand for higher quality food is another major contributor to the rise of specialty foods. It is affecting everyone in the supply chain. Food manufacturers are taking more care when sourcing raw food, while distributors and suppliers, like UNFI and Whole Foods, are changing the landscape of the natural food industry.

All of these changes are contributing to much higher demand and supply of specialized food, and choice remains the main reason behind The State of the Specialty Food Industry study.

The Rise of the Specialty Food Industry

As of this year, 65% of consumers purchase specialty food. Specialty food dominates sales revenue as well, with a peak income of $140.3 billion in both retail (78.4%) and foodservice (21.6%), an 11% increase from 2015.

Sales from specialty food and beverage have a share total of 15.8%, with plant-based foods dominating the first four spots. Due to the increased interest in organic produce, their input is expected to rise over the next five years.

When it comes to consumer retail purchase, mainstream channels hold an 82% share of total retail sales. However, the biggest winners are both the physical and online versions of the food service. Their sales have doubled in size over the two year period from 2015 and outgrew regular retail options.

On the other hand, retail makers are increasing their offer of specialty foods, which is raising their sales input, but it is growing at a much slower pace. Major chain supplies have only seen significant growth potential in the convenience, drug and vending channels.

When it comes to consumers and who is purchasing specialty foods, demographics reveal that the most significant number of consumers belong to the iGeneration (18-23).

Other Millenials are also significant consumers because generally, these groups have the highest awareness of what they consume. They also make the decision to buy specialty foods based on many different non-traditional factors, like benefits to health, environmental impact, and even trendiness.

Top Ten Selling Specialty Food Groups in Retail

In 2017, the top-selling retail products reached a combined total of almost $29 billion out of around $1.4 trillion of total food spending. It included fresh, refrigerated, frozen, plant-based, and health-focused food, which also had the most notable growth in retail sales.

What’s interesting, on the other hand, is the growth rate of specialty foods which peaked at a combined 12.9%. That’s 11.5% more when compared to all other food, which only achieved a 1.4% growth.

Seven groups in the top ten are chilled or frozen foods, which indicates the demand for other specialty foods will have to increase to create a genuinely diversified offer on the market. Here is a brief overview of the top ten specialty food groups and their performance on the market in 2017:

Cheese and Plant-Based Cheese – cheese achieved the highest sales total, reaching little over four billion in sales. But it’s growth was relatively insignificant with an average of just 6.6% from 2015, which indicates a stable demand for cheese.

Frozen or Refrigerated Meat, Poultry and Seafood – frozen meat in all its forms reached $3.8 billion in sales over the period. What’s most interesting is that it had the lowest change over the two year period between 2015 and 2017, with an average growth of just 3.3%.

Chips, Pretzels, and Snacks – this group is characterized by a top three spot when it comes to sales in 2017 with $3.8 billion (little less than the previous group). However, it had a below-average growth rate for the observed period with 11.8%.

Non-RTD Coffee and Hot Cocoa – owing to the love of coffee in the United States, it is not surprising that this specialty food group earned $3.3 billion in retail sales. Still, the traditionally loyal consumer base also means it had a low growth rate of only 5.4% over a two-year period.

Bread and Baked Goods – bread is a staple food group and earned an expected $3 billion in retail. What’s surprising though is the above-average growth of 18.1% from 2015 to 2017, meaning demand and consumption has risen significantly.

Chocolate and Other Confectionery – chocolate and confectionaries brought in a combined sum of $2.3 billion in sales last year. And according to the data collected from the previous two years, they exhibited a slightly below average growth of 10.8%.

Yogurt and Kefir – healthier dairy-based products like yogurt and kefir massed a total sum of $2.2 billion in retail sales last year. However, the market growth was excellent in the previous two years, and the specialized food group saw an increase of 20.6%, which is the third best value among the top ten groups.

Frozen Deserts – the frozen deserts group has a strong eight position in retail sales, earning a total sum of 2.2 million. More importantly, frozen deserts achieved the highest growth rate out of all the groups in the top 10 with 41.6% between 2015-2017.

Refrigerated Entrees – ready-to-eat refrigerated entrees gained a combined amount of $2.1 billion from retail sales, which was enough to secure them ninth place. But the good news for suppliers and distributors is that this group of specialty foods takes second place when it comes to exponential market growth with 27.2% change from 2015.

Frozen Lunch or Dinner Entrees – frozen lunches and dinner entrees performed similarly to refrigerated dinner entrees taking $2.1 billion from sales, which is a 13.1% of growth during a two-year period. But if you combined the two similar last entrees, they would top the list with $4.2 billion in revenue and 40.3% change.

The Bottom Line

Observing the changes in the specialty food market Denise Purcell remarked on future growth: “We see the future growth of the [specialty] category being driven more by foodservice, convenience, and vending. We’ve seen a lot of growth in drug (CVS, Walgreens, etc.) as well. You’ve got all these different players now that want to carry some of these products.”

If you want to know more about the general state of the food and beverage industry, stay up to date with the latest news. Use the most recent information as an opportunity to improve your offer, and boost your bottom line.

Please visit our website at www.cascadiamanagingbrands.com

Why User-Generated Content is What Consumers Crave

Beverage Marketing: Why User-Generated Content is What Consumers Crave

Fans create brands. And when it comes to brand marketing, there is nothing stronger than peer-to-peer promotion. Brand ambassadors and fans motivate other people to choose and use your products and services, like your beverages. In marketing, this is called user-generated content (UGC), and it’s what beverage companies need to offer their consumers because it’s how they want to be marketed and what they crave. Beverage Marketing is strong in peer-to-peer promotion.

UGC Increases Engagement

User-generated content relies on a successful content strategy. In turn, follows the latest industry news and allows for such marketing efforts to be included. It also relies heavily on the technology behind promotional channels beverage business use. There are a lot of different types of UGC content:

- Blogs – relieves some of the pressure from the marketing team and gives consumers a highly personal perspective on the brand;

- Comments – increase engagement on websites and social media and promote the brand through peer-to-peer communication about the brand;

- Reviews – impact consumers psychologically by increasing trust and credibility, and have the potential to affect 46% of consumer decisions.

- Images – establish visual contact between consumers and the brand through the direct use of the product and its promotion of personal and official online channels;

- Videos – increase brand awareness and brand perception through different interpretations of the brand and the direct use of the product.

Content like this requires promotion, so consumers become aware of its existence. Targeting different channels, allows more users to take part in and generate content.

Additionally, beverage companies should consider including consumer incentives for consumers to create content. Campaigns can include prizes, like discounts, special offers, a free supply of drinks, or branded material like flash drives, T-shirts, and even concert tickets. Just remember to make them useful.

UGC Builds Valuable Relationships

Brand identity relies a lot on the relationship a company has with its audience. Brands have to look towards aligning their value proposition with their brand message – core beliefs, mission statements, and goals. This type of communication is customer-centric and focuses on establishing a shared system of value on which a brand can build a relationship with its audience.

User-generated content can make this happen for beverage companies. It essentially allows consumers to take part in the development of the brand. For example, if your company wants to develop a new drink, it issues a campaign that gives an opportunity for customers to come up with a name for it. It empowers consumers, and they are more likely to consume the drink regularly (interact with the brand.)

UGC Inspires Loyalty and Creates Fans

According to marketing professional Kevin Kelly, a brand only needs 1000 true fans to succeed. In that sense, beverage companies need to focus their attention on returning customers and allow them to create user-generated content as a reward. In turn, this creates a loyal following of faithful fans, who know the company values their efforts.

It also creates trust – an essential element of loyalty. And with mutual trust coming from both sides, fans will become brand ambassadors of your company promoting the company to other consumers (what you want,) while you continue rewarding their loyalty (what they want.)

Conclusion on Beverage Marketing

A brand is only active if it has a strong following. And for a beverage company, beverage marketing is following the latest trends in the industry and creating user-generated content campaigns can be a great way to create a loyal backing. After all, it gives consumers the type of promotion they want and crave – created by them and created for them.

How the Trump Tariffs Are Set to Drive Food and Beverage Prices Higher

Imposed Tariffs Under Trump

Like any tariff, the Trump Tariffs are a collective series of government-issued duties on imported goods. In 2018, President Donald Trump imposed the first tariffs in January. In turn, affected the import of solar panels and washing machines into the US. Later, in June another series increased the tariffs of imported steel (25%) and aluminum (10%). According to Morgan Stanley, this covers 4.1% of all US imports.

These government measures sparked were intended at China. However, also managed to anger US trading partners, most notably Canada, the European Union, Mexico, and India. In July, all of the countries most affected by Trump Tariffs hit back and issued their tariffs on US imports. And a trade war began.

What Can We Expect?

According to former deputy assistant Matt Gold, of the US Trade Representative under Obama, these measures will drive higher prices of all consumer goods. The tariffs imposed on the US affect raw materials, the first prices that will rise will be in the manufacturing sector. Where many rely either on steel parts for their machines or aluminum for packaging. Beverages in aluminum cans will need to increase in price only because of the cost of raw material. Coca-Cola has already stated that it will have to raise prices because of the cost of production.

The most significant effect to small and medium-sized is the trade tariffs imposed by Canada. In 2017, total trade with Canada was 673.9 billion dollars and included everything from goods to services. Most major chain stores and suppliers import products from Canada. Which can have an effect on smaller and medium businesses across the board. Importers will need to charge more, to account both for their import fees and the export fees of their suppliers.

The tariffs against the US also mean there will be changes in agriculture due to import-export fees farmers have to pay for their farming equipment and resources. USDA proposed a 12 billion dollar aid to US farmers who are impacted by the tariffs. However, this will not stop the rise in prices of food since vital raw foods have been impacted including corn, wheat, dairy and pork products.

What Prices Will Go Up Under Trump Tariffs?

Currently, there is still food, and beverage surplus all across the US. Prices will remain the same until the goods imported after the tariffs have been issued hit the stores.

You might expect to see the first prices go up when it comes to raw foods. Examples like meat, bread, vegetables, fruit and dairy products, especially in small stores. Big stores like Walmart will hold on to their current prices longer, but not too long.

It will also impact the food and beverage service industry since they rely on fresh produce to prepare meals. Eventually, businesses will need to find solutions, and they might be forced to resort to firings, and people will start losing jobs.

Stay informed about all the latest industry news and find out how this story develops the way it will affect your business.

5 Ways Your Beverage Business Can Maximize Influencer Marketing

Beverage Business Marketing

An influential voice has the power to get people to listen, change their opinion and impact their decision. Therefore, influential people can resonate with their audience to benefit brands in any industry, even the beverage business.

And as one of the latest trends in marketing, beverage companies can use influencer promotion to raise awareness, increase engagement and get more people to drink their product. Here are five ways to maximize the effects of influencer marketing on your beverage business.

-

Find the Perfect Influencer

When it comes to connecting with a target audience, companies first need to determine a few things, like size, the sphere of influence, and personality before finding the right person for the job.

Micro-influencers have a following between 10,000 and 100,000 followers. It might seem like a small target, but their followers tend to be a tight-knit and loyal community which affect engagement. Micro-influencers are also easier to connect with and are cheaper or even free. And if they’re young, it also means the company is building for the future. In part, that’s why micro-influencers are considered the marketing force of the future.

Macro-influencers have almost celebrity status with several hundreds of thousands or even millions of followers. While their fans might not all be devout, these influencers still have an astounding reach, and their endorsement can have a tremendous impact on brand awareness. However, they are difficult to get a hold of or require substantial contract fees or incentives to promote a company.

It is also crucial that companies research potential influencers to see what kind of content they promote. For beverage companies, this means targeting influential people from the food and beverage industry or people who tend to use those products and publicly review them.

Food and drink bloggers and professional cooks might be the perfect angle to get products promoted through review. Service companies also follow these influencers, which is an excellent way of reaching potential retail partners. As for user-influencers, targeting local social media celebrities is helpful for B2C beverage companies looking to sell more products directly to the consumer.

Finally, once a company selects a shortlist of candidates, it is essential for them to initiate and establish contact with them. Influencer marketing is big business, and it is crucial to determine the price to see if it is a financially viable option.

-

Target Multiple Channels

Customers respond best to visual advertising when choosing what beverages to buy. Research shows how television food ads have a substantial effect on individual choice, especially in situations when other tasks occupy them. Translated into the digital world, it means there is a definite potential for influencer marketing on visual social media channels, like Instagram for images, YouTube for videos, and Facebook for both.

What companies fail to realize is that these are not the only channels. To truly maximize the impact of influencer marketing, companies need to expand their search and target multiple channels during a campaign. It might open them up to new consumers, or help them find their ideal target audience.

As mentioned, food and drink blogs are a great way to receive the endorsement and promote beverages to potential retailers and service providers. Influencer sponsorship is another way to maximize promotion, whereby a company can sponsor specific segments on favorite online events. It works exceptionally well when targeting smaller audiences engaged with podcasts or webinars.

Trying out different mediums at different points in the campaign in combination with customer surveys can maximize influencer marketing as it shows where a company can have the most significant impact. Plus, companies can learn from major brands in their industry, like Coca-Cola, and use some of the ideas on own their campaign.

-

Set Clear Goals and Track Them Through the Campaign

Before initiating an influencer campaign, a company needs to determine what it wants to achieve. It can be anything from increasing brand awareness to increasing engagement, or even conversion and sales. A company needs to complete a marketing audit to determine the current situation and decide what aspect of a business to improve.

These goals must be presented to the influencer, and a precise schedule and timeline must be determined. Also, a system of reporting must be included so the impact of the campaign can be monitored and improved if necessary. If targeting prospects through social media, companies should stay away from vanity metrics, and instead, focus on key performance indicators. Only like this can a business determine the success of the campaign and its financial viability.

-

Building a Relationship with the Influencer

Efficient company culture always centers around people. It’s what makes businesses appear more human. Translate this into influencer marketing, and it’s the role of the company to establish a good connection with their influencers, so they accept company culture and become fans of the brand.

Building a relationship with the influencer makes their work more meaningful, and this resonates with their audience. Regularly rewarding the work, sending free drink supplies or surprising them at their events with branded gifts will create a special bond and make their work more successful.

-

Create Content that Stands Out

One of the primary goals of influencer marketing is to direct potential leads and customers to the company social media and website, or even the page of its best selling product. As the visitors arrive at this location, they need to see the quality of content and recognize its value otherwise they will feel deceived, both by the influencer and the company.

For beverage companies, it could mean having branded content that is both educational and entertaining. Educational, since this type of material, is aimed at industry professionals looking to partner up. But there also needs to be compelling content in the spirit of the brand message or the different drinks, which can drive sales directly through engagement.

Creating regular high-quality content also helps the influencer select the best material to promote on his channels. At the same time, it also allows the company to remain independent and not rely entirely on the influencer and one marketing strategy.

Accept Innovation

Keeping up with the latest innovation trends in soft drinks also means accepting innovation when it comes to marketing. It means staying on top of the latest industry insights, to realize the potential and help the business grow. And creating a company that’s a leading influence in the industry.

F&B Industry Branding

How Branding is Evolving in the Food and Beverage Industry

In today’s food and beverage industry, consumers want brands to be authentic. Branding is evolving in this industry. They are quick to pick up when they aren’t authentic and to tell others on social media.

Brands have to keep customers fully informed about the products they buy. They also need to be smart and strategic to grab market share in a very competitive market.

Brands must first identify their target audience and then create value for them. Once they’ve attracted customers, they have to build trust to turn them into brand advocates. If consumers are happy, they are more likely to continue to buy products and recommend them to others.

Branding and Social Media Interaction

Brands need to listen to what their customers say, and today this is much easier because they can interact with them on social media. Brands are receiving feedback from customers and understanding more about them helps them to cater to their needs.

Social media offers brands opportunities to create emotional connections with their customers and explain more about what their products offer them. In turn, consumers are better informed than ever before.

They have strong opinions about the quality of ingredients, nutritional value, and health. If brands provide this information to those who are interested, they create an opportunity to build loyalty.

More than ever before, people want the brands they choose to reflect who they are as people. Food packaging is one area where this is seen. The designs must reflect environmental and social responsibility and make people feel they are making the best choices for their health and their identities as a whole.

Please connect with me on any on my social media accounts and my LinkedIn account.

Would love to read and comments too.