Snapple failed? What do you mean by that? You’re probably wondering this because you know that Snapple is pretty much alive and kicking. The brand is still here, and the drinks are indeed being sold. However, that’s not a good enough indication of a brand’s success. What’s more, even though a brand is still there, it doesn’t mean it hasn’t failed.

Those who’re into history about brands will also know about the famous disaster of Quaker Oats and Snapple. And yes, that’s precisely what we’re here to talk about. But that’s not all. I’m here to argue that Snapple didn’t just fail back in the 90s, I’m here to tell you that this failure never allowed the brand to truly recuperate and advance. The best way to support this statement is to look at the numbers. They never paint the wrong picture, and they are a great signifier of a brand’s success or failure.

Just take a look at the sales volume of Snapple Tea. Back in 2007, they sold 55.5 million cases, and in 2018 they sold 54.6 million. There were downfalls in between, and there were rises as well, but the numbers remained pretty much the same after an entire decade. They are unlikely to rise in the future either. And what’s worse, this is something that has been happening to the brand for a long time.

So, why is this so? We are here to argue that the main reason for this is the failed merger with the Quaker Oats Company. As Snapple was resold afterward and went over a number of significant changes, most of which haven’t produced any significant improvement, it can well be said that the failure Quaker Oats made to the brand was permanent. With that in mind, let’s take a look at what happened, what was done afterward, and all the lessons we can learn from it:

The History of Snapple

To truly grasp the failure and the lessons we can learn from it, we need to go back to the very beginning of the company.

Snapple was founded in 1972 by three American businessmen, Hyman Golden, Leonard Marsh, and Arnold Greenberg. They first envisioned the company as a part-time venture as they didn’t know much about juices and weren’t ready to give up their respective businesses.

The first apple juice they made gave the name to the company. As it was a carbonated apple juice, it fermented in the bottles it was in and caused the caps to fly off. Consequently, they made a portmanteau from the words’ snappy’ and ‘apple’ to show how the bottle caps simply snapped off the apple juice bottles.

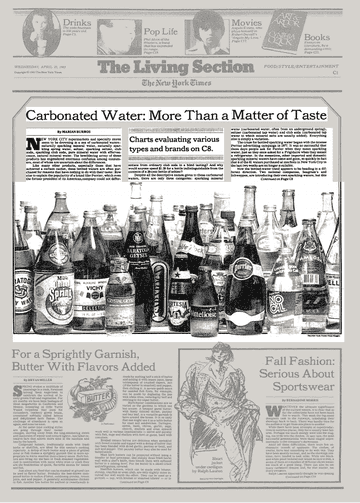

It took a while for the company to truly come to its own, which happened slowly in the 1980s.That’s also when the first new juices were introduced. Snapple first added all-natural juices at the start of the decade and in 1982, they started selling natural sodas. The prices were high, but the products were still relatively successful. Part of that success was brought by their attention to details as each product took at least six months to develop.

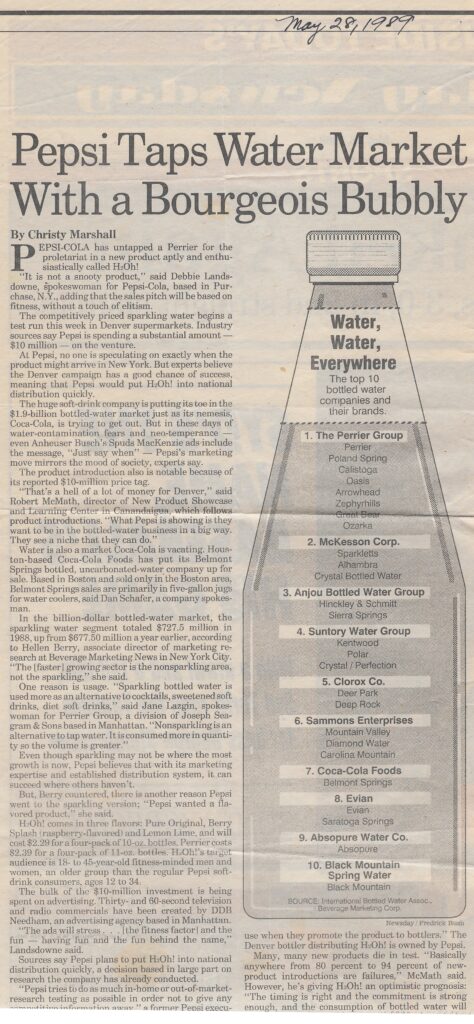

Thanks to this initial success, Snapple expanded into fruit drinks in 1986. Then, it didn’t take long for the Snapple Ice Tea to be born. It happened in 1987 and the most successful drink they ever made became their Lemon Ice Tea. This major success was due to their unique method of bottling hot tea which eliminated any preservatives. This was never done before so it wasn’t strange that their bragging point was that they were the first to create a read-to-drink tea that didn’t taste like acid!

To translate that into numbers, just in a single year by the end of 1988, Snapple sales increased by 60%.The success allowed them to introduce 53 different flavors and in 1989, revenues from all noncarbonated beverages increased by 600%!

It’s worth noting that part of that success also came from the fact that Snapple gave retailers refrigerators as awards for stocking the entire Snapple product line in their stores. In essence, Snapple was ahead of the competition in many ways during this time.

In the early 1990s, Snapple attempted to find success throughout the country with aggressive advertising. They tried a great many things, the first of which pushed them into the eyes of the American public. Each commercial they had featured Wendy Kaufman, also known as the Snapple Lady, answering mail from Snapple fans.

After the Snapple Lady, the company attempted many other commercials and types of advertisements, and in the end, they expanded their business to every major city in the United States.

What’s interesting here is that all this time, despite the expansion, the company was still rather small with only 80 employees, most of which worked in a modest office building the owners had on Long Island from the very start of their company. They achieved this by not bottling their own product, but by outsourcing the work to as many as 30 different bottlers across the states.

In 1992 came the first sale of Snapple, but a lot of things remained the same afterward. For instance, the three founders of the company continued owning one-third of it and were still included in the management.

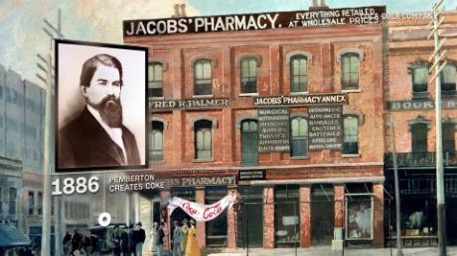

The heavy advertising that started before and continued after the purchase yielded success, at least for the new owner of the company Thomas H. Lee. Snapple was sold off for $1.7 billion, and Lee pocketed around $900 of that money for himself in 1994. The buyer of Snapple was none other than Quaker Oats, which is where our main story begins.

The Infamous Quaker Oats Acquisition

Quaker Oats had enormous successes at the time they purchased Snapple. Their Gatorade brand was bringing in around $700 million annually for a while, which created some significant amounts of cash the company could burn. What they did now seems like a literal interpretation of this metaphor. They decided to expand, and thus they purchased the Snapple brand for the enormous amount we just mentioned. Many experts considered the amount to be unnecessarily high, and in hindsight, it seems that it was.

Some two years later, when Quaker Oats sold Snapple off, they made around $300 million, which is a net loss of $1.4 billion for a single brand. So, why was this merger such a colossal failure?

Most now believe that there are several reasons for it:

- Wrong sales strategy

The sales strategy Snapple had before Quaker Oats purchased it was mainly supported by the gas stations and small convenience stores in which Snapple drinks were mostly sold. Quaker Oats wanted to change that mostly because they already had a great and working relationship with big grocery stores that sold their products. They thought that they could do the same for Snapple drinks, but they were vastly mistaken.

They tried to push this new method for no real reason besides the fact that it was easier for them. The strategy didn’t work out as Snapple sales plummeted instead of starting to increase as Quaker Oats management was hopping.

- A misguided advertising campaign

Remember the Snapple Lady line of commercials Snapple had? It was one of the main appealing points of the brand. Snapple fans loved the commercials and how unique and quirky they were. However, Quaker Oats decided to discontinue them and replace them with ones where Snapple boasts about how it would be happy to be right behind Coca Cola and Pepsi on the market. The new advertising idea completely made the Snapple brand normal and ruined the previously created quirky image it had. Suffice it to say, most old-time fans were not pleased.

After realizing the mistake they made, they tried to return to the original advertising style, but it was already too late.

- No adequate plans for the competition

Quaker Oats failed to make plans to fight the competition before they purchased Snapple. Before they did, Snapple wasn’t a major competitor to the big fish brands of Coca Cola and Pepsi, but once it was bought by a large company that was on par with the giants, they didn’t wait too long to prepare their countermeasures. They created their own Snapple competitors, which, combined with the fact that Quaker Oats did next to nothing, caused Snapple sales to go down.

Getting Rid of a Failing Brand

As it was already stated, Quaker Oats completely failed with the new brand, and they ended up selling it with major loss only three years after they bought it. This happened in 1997 when Triarc bought Snapple from Quaker Oats.

The CEO of Triarc, Michael Weinstein, attempted to undo everything Quaker Oats did to the Snapple brand, and in time, he succeeded. The original, quirky image was brought back and nurtured for a long time until most of the original customers were back. Even the Snapple Lady was brought back!

Beyond that, Triarc managed to increase the value of the brand and reach some of the success that could have happened much earlier had it not been for the devastating decisions and moves Quaker Oats had made.

Unfortunately, not a lot was accomplished except for the returned image and some further increase in sales. In 2000, Triarc decided to sell Snapple by bundling it together with Mistic and Stewart’s. The three brands were sold to Cadbury Schweppes for $1.45 billion, which was considered as a win by Triarc as they purchased Snapple for only $300 million.

Later on, in 2008, the brand was moved to its current owner Keurig Dr. Pepper, which was, at the time, under a different name and management. As of May 2009, the original Snapple drink was completely altered, and they began to make it with sugar instead of high fructose corn syrup. Today, the original formula is still being sold in some places, but it’s becoming very rare and likely to disappear from stores entirely.

Lessons We Can Learn from Snapple’s Failure

All the mistakes Quaker Oats made with Snapple can be boiled down to a single thing – a failure to understand the brand.

Quaker Oats never went in with the intention to understand their new brand and improve it in the way that the brand allowed. They went in thinking that their success with Gatorade can be transferred to Snapple. Yet the only thing that connected the two was the fact that both brands were beverages. Outside of that, the two couldn’t have been further apart.

At the time, Snapple was a quirky soft-drink brand marketed as a New Age soft drink while Gatorade was a sports drink with a massive athletic image. Comparing the two at the time was akin to comparing jocks to nerds in classical high school settings of the past.

As many have stated as early as back then – Quaker Oats failed to understand what Snapple was all about. Maybe they didn’t try to understand it, or perhaps they just weren’t aware that they didn’t understand that. Whatever the case may be, the fact remains the same – that failure to grasp what the brand was about cost Quaker Oats $1.3 billion and a tarnished brand image for Snapple that was never truly recovered.

As we’ve seen in the previous section, Snapple never truly found success after this debacle, and the entire brand remains a weak one that could have been much stronger.

In essence, this whole story shows how much the failure to understand a brand can be devastating for the brand itself, as well as its owner. Yes, it could be argued that later owners managed to reach success with Snapple, but as you’ve also seen, they were very limited and seemingly all in an effort to sell the brand again to someone and gain any profits.

Key Takeaways

Snapple could have been on par with the giants like Coca Cola and Pepsi, but they ended up being just another beverage brand among the many its current owners (Dr Pepper) have.

All in all, Snapple remains a good lesson for all brands and companies, not just the ones in the beverage industry, but beyond. It would be good for you to know what the lessons are of this failure and how important it is to truly understand the brand you have if you want to improve it and increase profits. As for deep dives like these, you should continue following my blog as I will be making many more in the coming months!