The Importance of Public Relations for Food & Beverage Brands

Hiring a public relations agency at the right time is crucial to the success of your brand, especially in this “Amazon Era”. A dedicated PR agency not only helps create brand awareness before and after a product launch, but also offers a plethora of services important to your overall ROI, including securing A-list press coverage, brand exposure, consumer activations, creative campaign ideation, social media management, influencer marketing, brand partnerships, and crisis communications, among other services.

Word of mouth is a powerful tool, however strategic media relations outreach and a measurable public relations program — whether you are a startup or an established brand launching a new product — will help determine the right messaging and strategic approach to ensure you reach your target consumer.

When to hire a PR Agency?

There is a common misconception that brands should engage a PR agency after they launch their product or service or once they are available for distribution, ie, at Amazon or other e-commerce platforms. Hiring a PR firm is like bringing on an experienced partner to help you throughout the “on boarding” process, from start to finish, whether it’s a rebranding, important company development or a product launch. Additionally, it often takes months to get a good PR hit (yes you get PR before 3 months),—but consider the time it takes to select the right media targets, the time it takes to send them samples, the time it takes to follow up, and the timing of their editorial calendar. Additionally long lead magazines like Everyday with Rachel Ray, Vogue, etc. work on “long lead” times which can be 3-6 months. Most long lead publications, as of the day of this writing, are already working on their November and December holiday issues.

Your PR agency will not only promote the launch of your brand or product, but will work with you from the beginning to develop creative strategies and ideas that will attract the media, retailers and distributors and your target consumer audience. They work in partnership with you to create key messages, support with website copy and content development, and conduct focus groups to learn what your consumers are looking for and how they will respond to your product launch. They often help in creating ideas that generate attention from distributors and retailers and make your brand stand out. No one wants to be considered “just another brand” by buyers.

Involving a PR company during your start up stages strengthens your brand’s credibility, builds momentum, and stimulates consumer demand. Consumer trust can also be destroyed when a company promises one thing but delivers another. Look at many poor Amazon reviews and you will see a lot of companies unintentionally over promise and under deliver. Therefore, messaging should be managed carefully. When it comes to a product launch, the consumer will already have perceptions of the brand’s product based on word-of-mouth, social media messaging, media articles, product reviews, and marketing efforts. By having all of these key tactics in place, you have a better opportunity to launch your produce or service successfully.

How does PR support Amazon reach & sales?

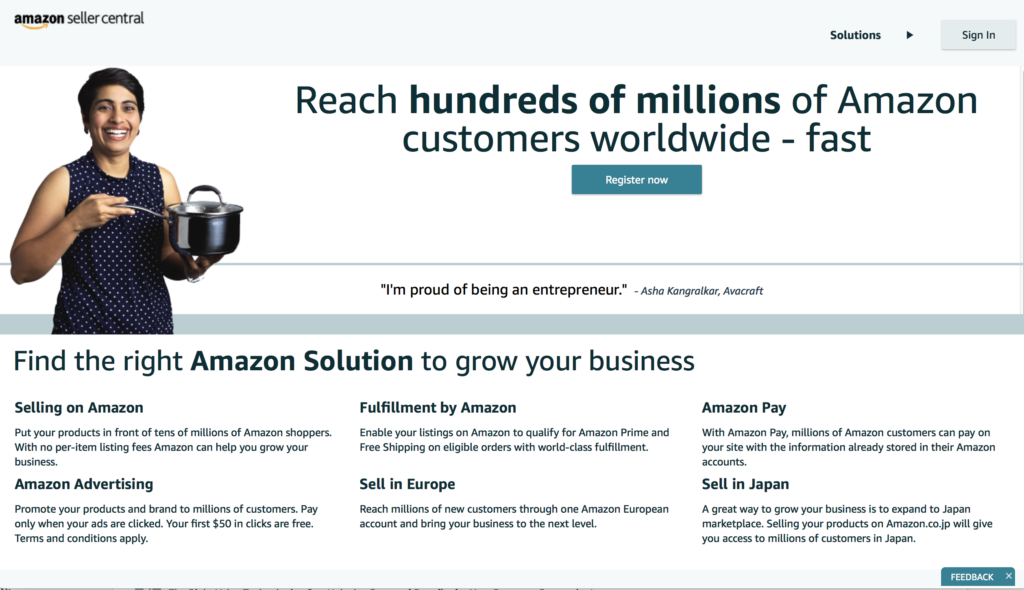

What role does PR play in Amazon sales and distribution? Product availability and Amazon distribution are promoted through public relation efforts via press releases, social media messaging and secured media coverage. When media outlets include a brand or product in a round up or feature article as a result of the PR agency’s outreach, they include the Amazon link where readers can purchase the products, resulting in sales and website traffic.

Another way PR can support Amazon sales is through influencer marketing. Influencer marketing has become one of the most sought -after channels to reach consumers organically. Whether we like it or not, content creators and influencers are here to stay and their power and influence in consumers’ behavior and choices will continue to grow.

Like many businesses, Amazon engages with influencers to promote its products through affiliated links. Through the Amazon Influencer Program, influencers receive a portion of the sales of a specific product they promote in their social media or blog when people click through the affiliated link. Although there are no additional fees for brands and Amazon covers the commission for each unit the influencer sells through their shop, there is no guarantee influencers will promote your product unless you are working directly with the influencers.

Here is where your PR agency comes in to support through an influencer partnership and campaign. Your PR agency partner can manage the influencer campaign on behalf of your brand by carefully vetting influencers, providing recommendations, drafting the messaging, providing key branding assets and overseeing deliverables and results.

For a brand trying to increase their sales on Amazon, leveraging influencers is a great way to raise brand awareness, grow exposure on the platform, and generate sales as influencers have the credibility and an audience who is looking for their recommendations.

Want to learn more?

Cascadia has partnered with CIIC (www.ciicnews.com) to provide consulting or project-based PR services to brands looking to successfully compete in the food & beverage industry. Contact Paola Cuevas at [email protected] to learn more about their food & beverage experience and how they can help you get your product in the news and “off the shelves” in no time.

Cascadia Managing Brands offers its clients outsourced sales, brand management, Amazon setup and sales, traditional retail sales, marketing, new product development, operations, production and logistics.

Cascadia Managing Brands helps brands reach critical mass faster, cheaper, better, and smarter. From business plan development to the actual execution of the plan, from strict consulting advice to managing your sales or sales team, marketing and operational plan; Cascadia Managing Brands is the outsourced resource for large and small beverage companies alike.

Cascadia Managing Brands has over 75 plus years of food and beverage experience including Evian, Zico, Hint, C2O Coconut Water, Nantucket Nectars, Fresh Samantha (Odwalla), Naked Juice and many more.

For more information about Cascadia Managing Brands please visit us at http://www.cascadiamanagingbrands.com. Please visit our Facebook Page at http://www.facebook.com/Cascadiamanagingbrands or our Twitter page at http://twitter.com/cascadiabrands.

For additional information about Cascadia Managing Brands go to www.cascadiafoodbev.com

So You Want To Launch A Brand? Why You Should Start Now (Part II)

This is the second installment of So You Want to Launch A Brands? Why You Should Start Now and we will discuss Branding, Positioning, Logo and Label Development as well as Intellectual Property and FDA Label Compliance.

Brand Positioning and Logo and Label Development

While you are waiting for your shelf life test results, if you haven’t already started, let’s focus on Positioning/Branding/Label/Logo Development. This is a very critical step in the process if not the most critical step.

To start, you need to determine what your Unique Selling Proposition will be. The food and beverage graveyard is cluttered with great tasting food and beverages that don’t sell because there is no Consumer Need. What makes your product different? What makes your product special? Why should a consumer purchase your product?

Sometimes this information is crystal clear to entrepreneurs and sometimes it takes a while. Please understand the world does not need another regular energy drink in the same size can and with the same ingredients of the Energy Drink market leaders.

There are a few ways you can handle product positioning. The first way is to do it yourself. Develop some reasons why you are unique and discuss it with friends and family. Sometimes this works. One of the risks involved in this scenario is that your friends and family might not tell you the truth because they don’t want to hurt your feelings. Another potential problem is your friends and family might not be the same as the consumer demographic you are targeting. However, it can be done and it has been done this way.

Another way to approach branding and positioning and your Unique Selling Position is to hire a professional like Cascadia (in fact Cascadia can do most of these steps for you) or you can hire other professionals like Arena Partners or Modernized Mobile, for example, or another reputable agency who will work within your budget. I have seen very good, small branding firms charge a few thousand dollars and done a great job and I have seen larger ones charge between $50,000 and $100,000. In this case, larger agencies do not always equal better work content and unique positions.

Listen to this. I am going to tell you a secret that will save you potentially millions of dollars. If you do not have a Unique Selling Proposition don’t start a food or beverage company. You will just be setting yourself up for failure.

The branding and positioning process should take about 30 days if you and your branding firm turn around content and feedback quickly.

Assuming you have your Unique Selling Proposition as well as your brand positioning, all of your marketing efforts will flow more smoothly.

Once you have the USP, it is time to design your logo. Logo development is a very iterative process. It can be done within 2 weeks to 4 weeks, again, if you and your designer turn around feedback and work product quickly. However, you need to be careful how you coach your designer and what you tell them. If you tell them you want squiggly lines that is what you will get, but it might not be good for the brand. The better approach would be to tell them you want some sort of abstract art in the logo. Don’t tell them you want the logo in red, for example. Let the designer do their job and give you various options to consider. Wanting what you want just for the sake of having it can create problems in this phase. After all, you don’t want a logo that you love but consumers hate. Remove your ego from the process.

Most branding and positioning firms can also create your logo and label.

Now that you have your logo it is time to start working on your label. Keep in mind during the development of your label you want to create something that will get the consumers attention AND is in compliance with FDA regulations.

First, your agency or designer need to create your label. After that, you should send it to an FDA attorney for review. Just because other people are saying certain things on their labels doesn’t make it correct or legal. An FDA attorney will also usually give you advice about the best ways to avoid class action lawsuits which are rampant in the industry, especially in California.

The label design and FDA label review (oh by the way, your website copy, point of sale material, sell sheets, and social media content should also be reviewed by the attorney but I won’t include that in the timeline) take about another 6 weeks or so, unless you need to live photography or custom illustration for the label. That will add more time to the process.

Intellectual Property and FDA Compliance

We work with several excellent FDA attorneys. Here are a few: Justin Prochnow, Rachel Gartner, and Rakesh Amin. These firms can also handle your trademarks and patents if necessary. Be prepared for a lot of comments to your label review. Very rarely have I seen a good review without a lot of comments.

We had a client who owned an AMAZING Trademark for a name. In fact, this client could most likely have made a lot of money from a much larger company who was infringing on their logo. Unfortunately, while day-dreaming one day, I searched their trademark (to this day I still don’t know why) only to find they never renewed it and it expired. They lost all the leverage they had on the larger company and, in fact, had to get the larger company to explicitly allow the Company’s trademark in a very specific channel. Not optimal at all. But I digress.

Cascadia Managing Brands is a strategy, brand management and sales execution firm that helps startups succeed. In this bi-weekly series Bill Sipper, Managing Partner, shares his insights on:

Brand Positioning and Logo and Label Development

Intellectual Property and FDA Compliance

Future articles will discuss:

Brand Positioning and Logo and Label Development

Intellectual Property and FDA Compliance

Point of Sale Material and Presentation

Liability Insurance

Distribution Strategy

Sales Execution

Overall Timeline

How to Cut a Sound Trail thru the Amazon Thicket

As published in Beverage Business Insights May 11, 2020.

There’s little question that online sales’ continuing inroads in the bev biz have become accelerated as conventional shopping has become more tortuous during the coronavirus pandemic. Data shared on Monster Bev earnings call last week showed that rival Celsius may be still modest at retail but it owns 10% category share on Amazon. BellRing Brands’ ceo said ecomm has jumped to 10% share of sales and may stay that way even post-pandemic. Those are eye-popping stats. Should your early-stage brand make the leap? Does the chaos of the current crisis make this a good time or a bad time do so? Bill Sipper, partner at Cascadia Managing Brands in Ramsey, NJ (CascadiaFoodBev.com), offers a primer here on what factors should go into your decision-making and how to plot your strategy.

“Our vision is to be the earth’s most consumer-centric company; to build a place where people can come to find and discover anything they want to buy online.” That’s Amazon’s mission statement. From a consumer perspective, they have achieved their goal. But what is missing from that mission statement? You, the vendor.

As much as Amazon cares about making consumers happy is as little as they are concerned about their vendors. Amazon can be daunting for even the most experienced food and beverage executive. (It certainly was a learning curve for those of us at Cascadia Managing Brands.) It is even more difficult for an early-stage entrepreneur with limited understanding of their digital space. And as I noted, Amazon doesn’t necessarily work hard to make it easy and intuitive for you. Having been steeped in these issues for our clients in recent years, I’m offering a few guidelines for navigating this challenging but potential rewarding channel.

A word first about timing. Much has been said about Amazon focusing on “essential items” during this pandemic. Yes, food and beverages typically are considered essential, but your early-stage brand may not be so essential at a time many consumers are more focused on staple items. Does this imply you should put off a launch until things settle down? Not necessarily, because of the time frame involved. It will usually take 8 weeks or more to get items listed on the platform. Amazon people are very meticulous and want information the way they want it. For example, quite often Amazon will ask you to prove that you are the brand owner and require specific, and somewhat odd, documentation to support that. It is not uncommon to receive approval to steps in your account only to have them unapproved the following day, as the company requests additional information. So the sooner one starts this process the faster the products will find a berth on the great ship Amazon.

If you decide the time is right to proceed, you first need to determine which Amazon platform is right for your brand. Amazon is not one unitary service. Rather, it offers 3 options, each with its pros and cons: Amazon Vendor Central, Amazon Seller Central Fulfillment by Merchant, and Amazon Seller Central Fulfillment by Vendor. Which platform do you choose? It all depends on your brand’s needs and your operational strength. You need to think this through because success on Amazon starts by choosing the optimal platform.

Product type and packaging are important here. Take ASC Fulfillment by Merchant, in which the order is placed on Amazon but the product is shipped by you, the seller. This is a much better platform for pills and powders, refrigerated products and glass packages (9 out of 10 times Amazon will not ship glass directly). Then there is ASC Fulfillment by Amazon, where you deliver your product to the Amazon distribution centers on consignment and it is shipped to the buyer by Amazon. This most often is better for shelf-stable and RTD food and bevs. Each of these platforms offers different options and opportunities. For example, Vendor Central allows you to participate in Amazon Pantry, Amazon Fresh and Prime Now, while the other platforms do not. ASC FBA automatically gets you a Prime designation while ASC FBM Prime offers that possibility but not a guarantee. This may all sound like gobbledygook to you now, but these are essential, crucial distinctions.

Your digital shelf on Amazon is completely different than your retail shelf. Although you will find some level of uniformity, realistically there is much more flexibility in digital. For example, in traditional brick & mortar you would most probably want to offer each one of your sku’s, sometimes individually, sometimes in multipacks, and sometimes in cases. However, you are limited to the room a retailer allows you on the shelf. The digital shelf is much different. You can offer any pack you want, whether a 3-pack, 4-pack, 6-pack or 12-pack. Variety packs and packs that meet a consumer subscription cadence are the gold standard on Amazon. So this is a key part of your strategizing for this platform. You need to settle on the right size and the right pack count with the right order cadence, and of course make this all work with your supply chain.

Price is also important – but maybe not as important as you might assume. When Amazon shoppers are polled on what’s most important to them, the top three responses tend to be: (1) free shipping, (2) most likely to have the product I want, and (3) better prices. According to Consumer Research Report by Salsify, 2019 69% of consumer will abandon a product page for lack of information or details, a significantly greater driver than price.

Therefore, the content on your digital page (again, think of it as a shelf) is critical, from the type and number of photos, to the titles, to the bullet points. All these things affect your search ranking. Reviews also help in the search rankings and consumers like to see what other people are saying. Focus on getting quality reviews, not quantity.

Last but not least is promotion and advertising. You don’t have an Amazon business without marketing inside Amazon and out. But don’t spend one penny until your content is right. Amazon offers programs ranging from pay-per-click (PPC) to brand sponsorship, product sponsorship and brand store. These need to be combined with search engine optimization and key words on your pages. Yes, it’s a complex matrix, but again, you won’t have a successful Amazon business without thinking these issues through.

I should note that one of the downsides of Amazon is the lack of overall data you will receive about your consumer. Yes, Amazon captures a great deal of data about its shoppers and their purchasing habits, but it doesn’t share much of it. For vendors using Seller Central, the only consumer data you will be able to see is age, household income, education, gender and marital status. Amazon owns the relationship with the consumer. Vendors would receive a lot more consumer data if they sold their products on their own website. But consider this simple bit of arithmetic: Amazon receives 200 million unique views per month, while the average food and beverage startup’s website will receive no more than 50-100 visitors. So do the math. More often than not, even with a lack of consumer data, the sheer consumer volume on the Amazon platform will offer greater sales. Brands would have to spend a considerable amount of money to secure enough views of their website to come close to Amazon’s sales potential. It is a tradeoff that needs to be considered.

If you have a very large brand and if you have a lot of capital to invest in Google search terms and pay-per-click ads, and you have a large database of social media followers, you might opt to sell your product from both your website and Amazon. That could yield incremental sales and capture your consumers’ data directly. However, if you don’t have a large amount of capital (although you still need some to support your Amazon marketing), then it is best to focus on selling your product on Amazon. If you happen to generate sales from your website, that is great. But I would not invest a lot of time there. It is worth noting in this context that Amazon is the #1 search engine for retail products. More than 70% of online consumers begin their product searches with Amazon, versus just 11% with Google. Think about that.

If you’ve read this far, you understand that Amazon can be very difficult to set up if you don’t know what you are doing. It is not as easy as just throwing some photos and words on a page. Today, many brands launch exclusively on Amazon because the barrier to entry and costs are relatively low compared to the requirements of operating in the bricks-&-mortar world, from recruiting distributors to paying slotting fees to running in-store demos. Amazon sold $8.2 billion of grocery items in the US last year (compared to Walmart’s online business of just $2.4 billion). It can be a great place both for large brands and small ones. But only if you have a plan.

So you Want To Launch A Brand? Why You Should Start Now

I started writing an article showing the steps and timeline for creating a new food and beverage brand. I wrote more than I expected so I decided to post the article in bite size pieces here on a bi-weekly basis.

The pandemic, amongst other things, has caused many entrepreneurs to pause and re-think their strategy. Many entrepreneurs who have great new food and beverage ideas are waiting to see what happens. I can say, that is a very bad strategy for entrepreneurs because while they wait, others will be moving forward and will be the first to gain shelf space when the country goes back to our new normal.

Let’s look at a typical timeline for a new food or beverage item. For arguments sake, let say you already have an idea in your head. What do you do next?

Research and Development

Let’s start with research and development. You might be able to create your product in your kitchen today but it will be much difficult once you move to the production phase. For a very basic example, let’s say you are using Heinz ketchup as an ingredient. If you were to order Heinz ketchup in a 50-gallon drum, the minimum size you can usually order for a production run, it would be very expensive. Depending on how much you use, Heinz Ketchup may make your product too expensive to sell or too expensive to make a profit. Heinz ketchup has a certain taste profile. When you move into production you will most probably need to buy a less expensive but high-quality ketchup. Where do you go for that? How do you sample the different types of ketchup being sold in bulk? Will the manufactures send you free samples if you are a startup?

This all leads up to you probably should hire a person or company, like Parkside Beverage, Beyond Brands, or Metabrand amongst other reputable firms. Get your recipe or formula done right the first time. In the grand scheme of things their fees are not a lot of money and you need to get it right the first time. Re-formulating takes time and money.

I have been on the floor of production facilities with clients who created their own recipes and were trying to adjust the formula on a fly. It was a disaster. I remember one time being on the production line when someone’s formula would not work because the ingredients were too thick and they were clogging the filters. That costs a lot of money. The client had to pay for the entire day of production even though he/she was never actually able to produce their product. My advice, stick with the professionals and they will save you a lot of money in the long run.

Now let’s look at the timing and timeline. Formulation companies aren’t waiting for new entrepreneurs to contact them. Even during these Covid 19 times, reputable formulation companies are still busy. They point is you can’t just pick up the phone and expect them to get started immediately. It might take two weeks until they can accept your business. It might take them time to order special ingredients.

Once they create the first batch of samples for you, and I am sure this will not be the last batch of samples, and you consider the time it takes for them to mail you the samples, and the time it takes for you to review the samples and send comments back to the formulator, and they eventually finalize the formula, consider 4 more weeks go by.

Now you have your formula. Great start. Do you want it to be GMO free? Organic? Kosher? These processes take time and someone has to fill out all the paperwork and get all the information for the certifier. My last go around with a GMO-Free certifier took 6 months because they are backed up. However, let’s say it takes 3 months. However, assume you can work on other parts of your product during that time period.

Shelf Testing

Let’s consider the next step being Shelf Testing. Before you produce your product, you want to know what happens to your product after being exposed to different levels of heat, cold, light, etc. Are any bacteria growing? What about yeast, pH, mold, salmonella, E. Coli, listeria, staph, aureus etc.? How long will your product be on the shelf before the color or taste or aroma begin to change? And this isn’t just a “nice to have”. Retailers and Distributors may request to see the shelf life test results.

According to RL Food Testing Lab, Product Safety Testing will take different times depending on the type of item you are testing.

Here are a few examples:

- Beef Jerky 9 months – 1 year

- BBQ Sauces 4 months – 6 months

- Pasteurized Dairy Products: 3 weeks

- Raw Juices 5 days

- Cakes, Cookies & Other Bakery Goods WITH preservatives 30 days

- Salsa 3 months – 4 months

But now, you need to test for shelf life. How long will your product last before going bad or before losing taste, aroma or even color?

The rule of thumb regarding shelf life testing, depending on the product, is that a product needs 1 week of testing for every month of shelf life you are looking for. But, that timeline may be a little bit over cautious. For the sake of this article, let’s say it takes you 90-120 days until you get your test results.

Cascadia Managing Brands is a strategy, brand management and sales execution firm that helps startups succeed. In this bi-weekly series Bill Sipper, Managing partner, shares his insights on:

Product Formulation

Certifications & Testing

Future articles will discuss:

Brand Positioning and Logo and Label Development

Intellectual Property and FDA Compliance

Point of Sale Material and Presentation

Liability Insurance

Distribution Strategy

Sales Execution

Overall Timeline

The Great Recycling Con Job?

We are all today brought up with the belief that recycling is important. Experts, people of power, and organizations constantly tell us that recycling is vital if we want to ‘save the planet.’ However, the reality is far more complex, and there’s a lot more to it than you might think.

First of all, when we’re environmentally conscious, we are not only saving the planet, we are saving ourselves. It’s presumptuous to think that any of our individual actions can destroy or save the planet on a global level. We are just one living organism among a whole host of living organisms on Earth that has occupied it for millions of years. They all came and went, and the planet is still here. We are a mere second in the entire existence of the world.

In essence, all the bad we do to the planet will only lead to our own extinction, and the Earth will continue to exist long after our demise.

But besides the fact that we are not saving the planet when we recycle, we are also not really recycling. At least not in the way we are told. You want to know why? It’s a long story, but by the end of this post, you’ll know the real truth about recycling – the one no one will tell you.

Before we begin, you have to understand how recycling works in this day and age. Let’s begin:

How Recycling Works

Recycling has been around for long enough that the very word has come to symbolize one thing – turning something that is no longer useful anymore into something new instead of throwing it away. But how does the recycling process work exactly?

We, regular citizens, throw our recyclable waste into the eponymous blue bin instead of the regular garbage can. A recycling truck comes and picks up the recyclable waste we throw away. The truck then takes the garbage to the recycling plant. There, a very complicated process happens through which all of that garbage is turned into raw materials that can then be turned into something completely new.

Naturally, the process is not endless. Every recyclable product is usually down-cycled, which means that the new product can never be the same as the original. For example, when old newspapers are recycled, the paper will still contain residue ink, and the fibers within the paper will be much shorter and weaker. For that reason, the recycled material won’t be as desirable for the same product, but it can still be used for something else. The same thing happens with most other products. And after a couple of rounds through the recycling processes, the material will reach a point where it will no longer be usable. So, returning to our example of paper, after it’s been recycled repeatedly, the paper will no longer be usable and can only be discarded.

However, that doesn’t mean that some products can’t be up-cycled, because they can. By being smart, we can turn certain products into even better ones. For example, one could make a whole furniture piece out of old plastic or aluminum cans and a bunch of newspapers. Even old wood can be reused to create something new and equally beautiful. However, in the majority of cases, products are only down-cycled and eventually become unusable.

So, is that the truth about recycling? Well, yes, but there is still more to it. This is just a lesser-known fact about recycling, but there is still the big truth that will completely alter your opinion on recycling.

What the Companies Don’t Want You to Know About Recycling

As it turns out, there is a lot that companies aren’t saying. It’s as if they are covering up the big truth, or several of them. The biggest one is the fact that not all plastic is recyclable. This is important because the biggest polluter among the waste we create is plastic. The main reason for this is the amount of plastic we create and how long it takes for it to decompose.

For example, it takes only two weeks for paper to decompose, which is why paper garbage is not a big problem in the world. The real problem is the amount of trees we chop down to make it. But I digress. Organic waste decomposes fairly quickly as well, from a few weeks to a couple of months. The real problem is the materials that take very long to decompose. For instance, nylon fabric takes up to 40 years to decompose, while rubber takes as much as 80 years.

But all of these relatively common products are nothing in comparison to plastic. It takes plastic a whopping 450 years to decompose! Once you take into account that plastic was invented in 1907, you quickly realize that none of the plastic that has ever been produced has decomposed by now. All of it is still here. And do you know how much of it? The latest study from 2017 states that 91% of all plastic never gets recycled. That’s around 8.3 billion metric tons of plastic, and all of it is now waste. What’s more, only 12% of all the plastic that has ever been made has been incinerated. The rest of it is polluting our land and the world’s oceans.

According to National Geographic, A whopping 91% of plastic isn’t recycled, even though we put them in those blue bins! Many mixed plastic and paper cartons (Tetra Pak for example) do not get recycled, contributing to 78 million tons of packaging waste in U.S. landfills as of 2015.

To an extent, this is our fault. But mostly, it is the fault of the brands that create plastic products. For example, Coca Cola has recently been named as the world’s biggest plastic polluter for 2019 – again. An audit that was conducted by Break Free From Plastic, an environmental justice group, has shown that Coca Cola makes 43% of all plastic waste. Nestle and then Pepsi follow Coca Cola as the world’s biggest plastic polluters.

The problem with all of this is that not even the previously mentioned 450-year mark is certain. We don’t know for sure how long it takes for plastic to decompose as none of it has existed long enough to decompose. Therefore, 450 years is just an estimate.

Now, most of us believe that we are doing good when we recycle plastic. So, in essence, if all of us were to start recycling, there will be no plastic waste in the world, right? Well, that’s very wrong. Remember what we said before? The part that mentioned that not all plastic is recyclable? We were talking about the plastic that’s put in the blue bins – the one that’s recyclable according to their label. As it turns out, out of the seven types of plastic that are ‘recyclable’, five of them hardly get recycled at all. According to the Environmental Protection Agency (EPA), out of all the plastic that was put up for recycling in 2017, only 8.4% of it was ultimately recycled. The other 91.6% went to the many landfills and into the ocean. The same report from the EPA states that, on average, 50% of all other waste is usually recycled. So yes, the biggest issue is plastic.

If you think this is already very bad, you will be surprised to know that it used to be better, at least for the United States. It seems that the US used to send about 20 million tons of garbage to China, and they were the ones who were supposed to deal with it. But in the end, they decided that they were not going to do our recycling for us. The same happened in the Philippines and Malaysia. As it turns out, these countries began to have their own environmental issues when it comes to waste. Now, many states or counties in the US don’t even have good recycling programs anymore because of this.

This brings us to the second big truth.

What the FTC Doesn’t Want You to Know About Recycling

The second big truth about recycling involves the FTC or the Federal Trade Commission. As you are probably already aware, most products we buy have that small green triangle symbol that denotes that the packaging is recyclable.

The FTC is the one that allows companies to put this symbol on their packaging. With that in mind, you would expect the commission to have some specific and strict rules which force the companies to create fully recyclable packaging. But alas, that’s as far from the truth as one could get.

The rules and guidelines set by the FTC are very complicated, so I won’t get into them as I don’t even understand them entirely. But what I do get and what it all boils down to is that companies can find many loopholes and vague rules that allow them to put the little triangular symbol on almost anything. And what ends up happening is that a significant portion of the products that boast that symbol still don’t get recycled in the end.

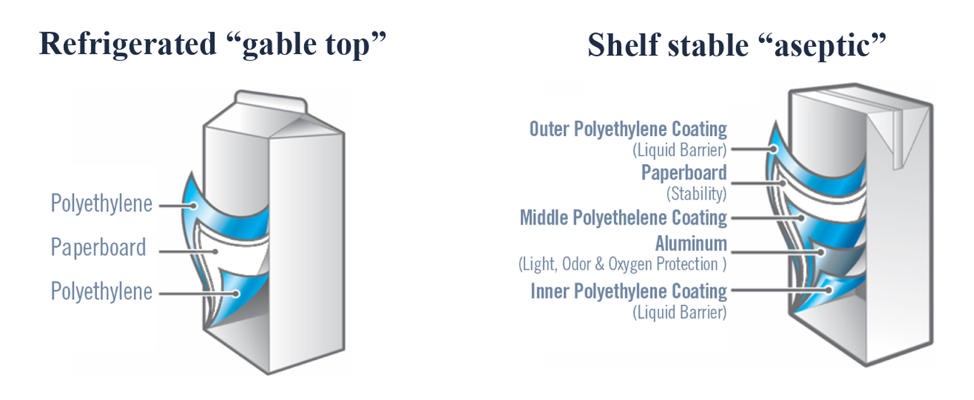

The best example of this is the famous Tetra Pak packaging that’s widely used across the globe, not just in America. As it turns out, Tetra Pak is not as recyclable as we are led to believe. According to the regulations set by the FTC, it is recyclable, but according to common sense, it’s not. That’s because the process used to recycle Tetra Pak is overly complicated and rarely used. Plus, parts of the Tetra Pak don’t get recycled. The result is that a lot of the Tetra Pak packages end up in landfills or the ocean as not all of it is recycled.

Paper, plastic, and aluminum are layered together to make cartons: A typical shelf-stable carton averages 74 percent paper, 22 percent plastic, and 4 percent aluminum. A familiar form of this packaging is unrefrigerated soup or wine cartons.

Refrigerated cartons skip the aluminum and usually contain an 80 percent paper and 20 percent plastic combination to hold in the liquid. The Carton Council of Canada provides extensive information about the composition of different types of cartons and their recyclability.

Source: Carton Council

Tetra Pak is just one example. Many other products are allowed to have recyclable labels on them, and yet they rarely end up being recycled. Even though that’s the case, the companies that create these products want us to believe that recycling is good and vital for us. By doing that, they keep us wanting to buy their products. Because for as long as we are incredibly eco-friendly, we will continue to purchase their products, knowing that what we throw them in the big blue bin will that will send them to the recycling plants. It’s a win-win situation, the companies make money, and we are all eco-friendly in the end. But, as you can see, we aren’t, not really.

So, if so much of the garbage we make ends up in a landfill or the ocean, is there even a point to recycling? Yes, there is.

Key Takeaways

Even though the big truth is that so little of what’s supposed to be recycled ends up being recycled, it’s still vital for us to keep recycling our waste. None of this changes the fact that a lot of the garbage we create ends up in the recycling plant. And even though a large portion of it doesn’t, that shouldn’t mean we should stop trying altogether. The little effort we make still means something. And it’s not like we can stop buying everything just because we know it might not get recycled.

What we really need is for the FTC to start making better rules. We need those guidelines to be stricter so that companies are forced to create products that will always end up recycled. We also need them to enforce real penalties and impose massive fees for those that don’t follow the guidelines.

However, we also need companies to start finding ways to deal with the plastic and other waste they create that ends up in the landfills and oceans. They are the ones causing the biggest problem with the waste crisis we have today.

We also need consumers to buy less plastic. Switch to cans and glass whenever you can. Almost everything you can buy in plastic is available in glass or cans. Ask your retailer to purchase more can and glass beverages. You have responsibility too.

I feel that the first step towards real change is for all of us to learn the whole truth. Once we do, we can start spreading it. The more people who know the truth and react to it, the more the government and the companies can work towards fixing the mess they created.

In the meantime, you should keep following my blog because more stories like this one are going to follow!

It’s Time for Glass Again — Can We End Beverage Industry’s Use of Plastic?

When was the last time you were able to purchase a soft drink in a reusable glass bottle?

When was the last time you even saw a soft drink in a glass packaging?

Today, single-use plastic packaging is still omnipresent, despite our increasing environmental awareness. According to a World Wide Fund for Nature study, an average person consumes 1,769 tiny plastic particles and fibers every week just from drinking water. That accumulates to around a half-pound of plastic every year!

And we aren’t the only ones feeling the impact of plastic. We might be the last link experiencing the results in the huge chain that makes up our environment. Unfortunately, the beverage industry plays a significant role in plastic pollution of the Earth. Let’s have a closer look at how plastic impacts our environment and whether we could turn the bleak trend around by going back to glass bottles.

Environmental Impact of Plastic

In the ‘60s, plastic waste was observed in the oceans for the first time, which ended the reputation of plastic materials as entirely positive and great to use. Even though plastic helped our industrial advancement, especially in the years after World War II, we did not have enough foresight to predict its environmental impact.

And it is dire, mostly because that plastic, made from synthetic materials not found in nature, can take forever to decompose on its own. Most plastic bottles take at least 450 years to biodegrade, and only if they weren’t made with Polyethylene Terephthalate (PET).

Today, plastic pollution is a huge problem — it has contaminated our oceans most of all. Toxins from plastic find their way into plankton, which is the base food of most marine ocean species. It travels through the entire food chain, ending up on our own tables.

But our air and land are also polluted. When plastic is burned to dispose of it, toxins are released into the air. While it waits for its turn to be disposed of in landfills, we end up needing more and more space for storing garbage.

According to Science (website), about 8 million metric tons are thrown into the ocean each and every year. This is the equivalent weight of approximately 25,000 Empire State buildings (website). Even with current recycling and conservation efforts, the amount of plastic in the oceans will increase 10 times by 2020 (website) and by 2050 there will be more plastic in the oceans by weight than fish (website). Recently, a dead whale in the Philippines contained more than 88 pounds of plastic in its stomach (website). Has anyone asked what happens to that plastic when we eat the fish that live in our oceans?

The global annual production of plastic exceeded 350 million tons in 2013. By 2015, the world had produced 7.8 billion tons of plastic. Back in the day, single-use plastic seemed like a great idea — but we are overproducing it, drowning in it, and making the entire planet sick in the process. And it is time to re-think single use plastic beverages. Recycling has failed to fix the ultimate problem.

According to Greenpeace (website) and the Breakfree from Plastics Movement (website) the top four plastic polluters in the WORLD are, from highest to lowest, Coca Cola, PepsiCo, Nestle and Dannone.

This conversation is not simply about the birds and the bees or “fishees” in the ocean. This conversation is about the world in which human beings live and the net effect plastic has on human beings, current and future generations. It is impossible to argue that plastic is good for mankind. It is convenient and it is less expensive, but that does not make it acceptable. Food and Beverage companies need to take responsibility for the damage they are doing to promote their bottom line.

Use of Plastic in the Beverage Industry

The beverage industry is one of the major players in the plastic packaging market — especially the companies that produce soft drinks, like Coca-Cola and PepsiCo. According to Greenpeace, Coca-Cola Company alone produced more than 100 billion plastic bottles in 2016. And if we compare this statistic to the data stating that over 90% of plastic isn’t recycled, it becomes easier to put the beverage industry plastic pollution into context.

In the earlier years, these big names in the industry committed to plastic, believing (or simply stating) that they would increase their efforts to reclaim and recycling it. However, with a lack of deposit systems and financial incentives to recycle, the system ended up being wasteful. Around 70% of bottles are never reclaimed, which leads to a low recycling rate. According to Euromonitor data, less than 7% of recycled bottles were turned into new bottles.

Beverage giants like Pepsi are aiming to start using biodegradable plastic. However, according to some experts, this will take a long time to accomplish, because the packaging must still be able to preserve the contents. What’s more, even biodegradable plastic can release damaging gases into the air, such as methane.

Initiatives against the Use of Plastic

Slowly but surely, the public opinion grows harsher towards plastic, especially single-use plastic that is most responsible for pollution. More and more initiatives against it are cropping up, and we might soon ensure that the industry as a whole takes a turn to a different direction.

One of the most notable ones is the New Plastics Economy Global Commitment, which was launched in 2018 by Ellen MacArthur Foundation (EMF) and UN Environment. It has 250 corporate signatories, including Danone, PepsiCo, and Coca-Cola Co.

All of the signatories committed to a few decisive actions to complete by 2025:

- to take action to eliminate unnecessary or problematic plastic packaging;

- to move away from single-use models towards reuse models where that’s possible;

- to use recyclable content in all their plastic packaging;

- to make 100% of their plastic packaging reusable, compostable or recyclable.

While these efforts to make plastic packaging recyclable and to improve our recycling systems are a step in the right direction, perhaps we need to look away from synthetic substitutes and slightly different alternatives. There are much more sustainable packaging solutions, one of which the beverage industry has used in the past. Of course, that would be glass packaging.

Use of Returnable or Recyclable Glass Bottles

In 2012, we saw the last ever returnable glass Coca-Cola bottle pass away into beverage history. Soft drinks and glass bottles used to be great friends in the early days of the industry, as the glass bottles were able to endure the pressure of carbonation.

However, the practice of returning glass bottles had nothing to do with sustainability or environment preservation back in the day. The reasons why consumers were incentivized to return glass bottles to the manufacturer with a bottle refund fee were the price and difficulty of the manufacturing process. The bottles were therefore considered company property, and consumers would return them to be refilled and reused.

Eventually, the glass bottle was overshadowed by the plastic model, as it was much easier and less expensive to transport plastic safely. Plastic bottles were considered to be more lightweight, resistant to breakage, and therefore superior in every way when compared to glass bottles. The environmental impact wasn’t considered or analyzed.

Benefits of Reusing Glass Bottles

What beverage companies were unaware of was that the practice of reusable glass bottles helped keep excessive amounts of waste from the landfills. But as it turns out, plastic isn’t the superior packaging material in any aspect other than weight and resistance to breakage. Glass bottles are more hygienic, and more capable of preserving the contents without a change in flavor, strength, and aroma — not to mention their aesthetic appeal.

Overall, there are multiple benefits to returning to the practice of using glass bottles for the packaging of soft drinks. Perhaps the biggest obstacle to returning reusable glass bottles as the industry standard is the way things are done nowadays.

Since there is no standard glass packaging, every bottle looks different. That makes reusing more difficult, as we have to sort our glass bottles meticulously to determine which ones we can recycle, and which ones we can return and where. The process for the consumer isn’t straightforward — but could it become more so?

Could Beverage Industry Start Using Glass Bottles Again?

If we take a look back, we could find the time where most liquids were packaged into glass bottles to be refilled and reused, and learn from it. Before World War II, that used to be the industry standard. However, all glass bottles were identical and therefore, easily reusable.

That would make the process easier to re-implement today. Beverage companies tend to avoid reusable glass bottles because the difference in design requires extra efforts in sorting. What’s more, collecting and transporting reusable glass bottles requires more storage facilities and labor. For most beverage companies, that would mean involving the retailers into the collection and shipment, which overly complicates the process, especially when compared to single-use plastic.

However, it would still be possible to reintroduce reusable glass bottles as the industry standard. It might take some time, but the results are worth it: 93% less energy consumed by a refillable bottle that can be reused 25 times, as opposed to one-way glass bottles. Of course, when compared to plastic it becomes even more evident how much better reusable glass bottles are: the use of energy in MJ and the CO2 equivalent of its Global Warming Potential is the lowest of all container materials.

Reusable Glass Bottles and the Glass Bottle Market

Reusable glass bottles will be the clear favorite if we wish to implement more sustainable practices. However, it would require preparation, as we would have to standardize our glass containers to make the process easier.

Today, companies that make refillable glass containers have packages of different sizes and shapes, even colors. This might be a contributing factor in the low return rates of refillable glass bottles (that also contributed to the eventual decrease in their use).

But what if bottles were standardized, and returned locally for sanitization and refilling? Then we could implement the reuse of glass bottles on a bigger scale, and ensure that one bottle does get returned 25 to 30 times to maximize sustainability.

The glass bottles and containers market is also growing, and showing potential for more progress thanks to European consumers. It’s predicted to reach $76 million in value by 2024. Most of it was glass for recycling and not refilling — European average recycling rate is an estimated 54%, as opposed to the reuse rate of 7%.

Aluminum Cans are Another Possible Solution

According to Chasinggreen.com, aluminum is 100% recyclable and can be recycled almost indefinitely without loss of quality or durability. They can be recycled, repurposed, and back in the store in as little as two months and the average recycling rate of aluminum cans 68%, the highest rate of recycling of any resource. The use of recycled aluminum in manufacturing utilizes 95% less energy than creating aluminum from raw materials.

However, there is also a negative side of aluminum cans. The aluminum industry was responsible for 140 million tons of CO2 production in 2005 alone and it is a non-renewable resource. It also takes 2-4 tons of bauxite to produce just one ton of aluminum through smelting and refining. Aluminum production spends over $2.3 billion annually for energy. Most of that energy is used to create aluminum: over 1 quadrillion Btu of electricity a year and some research suggests that BPA, a chemical lining found in some aluminum cans, may pose health risks.

What Consumers Think

One of the most critical pieces of the puzzle will be the consumer, requiring a change in behavior to move from pollution to sustainability. The good news is that consumers are becoming more environmentally aware and putting more stock into sustainable products and solutions.

According to a report by Pro Carton, 75% of European consumers have stated that the environmental impact of the packaging of a product affects their purchasing decisions. What’s more, they are also influenced by the media coverage of pollution, especially when it comes to marine pollution.

The majority of consumers tend to prefer more environmentally-friendly options while shopping, especially if it doesn’t cost them much extra to help preserve the planet. However, that doesn’t mean they aren’t prepared to pay more: 77% of Pro Carton survey responders said they were prepared to do so. In addition to that, 58% of them would support increased taxes on non-sustainable packaging in order to incentivize brands to think harder about their environmental impact.

All of these statistics are very encouraging and clearly show that we’re ready to start making crucial changes. Even the major players thinking only about profit can benefit from meeting consumer demand for sustainability.

It’s Time for Glass Again

Can the beverage industry’s use of pollution-inducing plastic packaging end? It certainly can. While there are some disagreements on which materials should replace plastic, the message is still loud and clear — beverage companies and entrepreneurs have to change their ways.

Glass packaging, especially reusable glass bottles, could be the answer to the environmental crisis we now face. With a low carbon footprint and multiple other benefits regarding the quality of packaging, glass would be a great choice. And if we made an effort to make reusing glass bottles more accessible and more standardized, market research shows that consumers would rise to the occasion and help make it the new industry standard.

Reducing plastic pollution should be one of the main priorities of the beverage industry. To accomplish this task, now might be the time to start using glass again.

Key Takeaways

It’s our responsibility as beverage industry leaders, entrepreneurs, and consumers to demand and facilitate change. Today, every link of the beverage industry chain might be ready to commit to making this change a reality.

Getting rid of the beverage industry’s share of plastic pollution by implementing more sustainable options, glass bottles or even re-usable glass bottles, might be of utmost importance for the future of this blue planet. If we don’t turn away from plastic now and start repairing the damage we’ve made, it might be too late in a few decades or even a few years.

It is time to admit the conversion to plastic from glass has failed and these companies continue to fail mankind in favor of profits. Human beings are almost equally complicity by purchasing these products. It is time for the Big Four to eliminate plastic products and force competitors to convert as well. It is time to end plastic for profit over convenience.

Why Large Food and Beverage Companies Fail at New Product Development

In the food and beverage industry, even the giants can have a hard time developing and launching new products. However, their troubles are usually entirely different from that of a food and beverage entrepreneur. These huge companies have all the advantages of troves of data, experienced marketing departments, and plenty of resources to make the new product succeed. But they still fail.

In fact, according to multiple sources, approximately 80% of new products developed by large food and beverage companies end up failing. This is a staggering statistic that perfectly showcases the scope of the problem. But why does this happen so often, and is there a solution that can turn this trend around? Let’s have a closer look at why large food and beverage companies fail at product development:

Big Companies and Innovation Struggles

As technology began to advance, most innovation in the food and beverage sector was tied to finding ways to prolong a product’s shelf life or get it to consumers faster. But today the market’s needs and appetites have grown way beyond this, especially as the consumers’ attitude towards food and nutrients changes.

Consumers are becoming more aware that what they eat and drink has a significant impact on their health, so they are seeking out the best possible options. That’s why large companies that don’t have a lineup of healthy, good-for-you products are finding themselves in a problem when developing new products. And unfortunately, the vast majority of big food and beverage companies falls into this group, as the trailblazers of new healthier trends are usually smaller businesses and food entrepreneurs.

To Reformulate or to Relaunch?

According to IRI, of 10,000 new products that are launched every year, as much as 90% fails to achieve sales goals. In fact, many of them aren’t even around two or three years down the road, which makes launching entirely new products a risky undertaking for most companies. In most cases, they decide to reformulate or relaunch their existing products to make them more appealing to the changing public opinion on how our food and beverages should be.

If we take a look at Consumer Good Forum statistics, we can see that 66% of their members have reported having reformulated some of their products in 2016. Some of the most common changes implemented in product reformulation are reducing the amount of sugar and sodium, adding vitamins, or using healthier alternatives to certain staples (such as switching to whole grains).

Declining Sales and New Product Launch Fails

The main reason for relaunching existing products is declining sales. Between 2012 and 2015, the U.S. retail sales of the top 25 food and beverage giants have gone down from 66% to 63%, according to the study Is Big Food In Trouble by The Hartman Group and A.T. Kearney.

However, the need for change hasn’t prevented new product development and launch fails. A few reasons stand out. There were cases of companies making the wrong conclusions on what the market needed, developing products that didn’t fit with their brand image, and choosing the wrong trends to chase.

Wrong Conclusions on Market Wants and Needs

Despite having a wealth of data at their disposal regarding products, taste tests, and market research, sometimes companies just fail to ask themselves whether someone will be willing to buy the product and at what price.

For example, let’s have a look at Coca-Cola’s C2, their attempt from 2004 to gain the favor of a target market that’s been avoiding their products. C2 was meant to be a middle ground between classic Coke and Diet Coke. The idea was to capture the interest of 20- to 40-year-old men, who were mindful of their calorie intake while avoiding Diet Coke because of its general appeal to women.

However, C2 only had half the calories and carbs of a classic Coke — it wasn’t a complete no-calorie version like Diet Coke. As such, its qualities weren’t distinctive enough to allow it to stand out in the market, even if it did (in theory) need a similar option. The target consumers simply didn’t find it appealing enough.

Just because a Company spends a lot of money on or does a lot of consumer research doesn’t mean they are correct. If that were true, Coke and Pepsi, and other conglomerates like them, would never fail. But that is not the case.

Research needs to be combined with gut instinct to be successful. If you look at the most successful, “new”, innovative and disruptive brands, none of them used expensive and extensive consumer research in the beginning:

Amazon

Bai

Boom Chicka Pop

Deep River Snacks

Dirty Lemon

Dirty Potato Chips

Fiji

GT Kombucha

Kettle Chips

Keurig

Liquid Death

Mama Chia

Monster

Naked Juice

Netflix

Perky Jerky

Pirate’s Booty

Red Bull

Smart Water

Sophie’s Kitchen

Starbucks

Vita Coco

Vitamin Water

Voss

Whole Foods

Zico

The Product Doesn’t Fit with the Brand

Big companies also face difficulties trying to expand their lines or launch new ones with products that stand out from what they were known to do. When many companies first reformulate their existing lines and launch new products that are more in line with the new brand image, there are sometimes cases where the consumers aren’t prepared for the change.

More often than not, these fails come from a brand branching out into the food and beverage industry — such as Colgate’s frozen lasagna or Cosmopolitan’s yogurt. However, that isn’t to say that food and beverage giants are immune to developing products that just don’t fit with the brand image, whether that’s in a big or a small way.

Trying to Capitalize on a Trend

Finally, one of the biggest and most frequent causes of new product development fails is chasing the wrong trends or fads. When a company is too early or too late to the current consumer preferences party, it inevitably brings low interest and even lower sales. Trends like low-carb diets have proven fleeting, which is something Coca-Cola has felt with their C2 release as well.

However, some notable innovations are still prevalent in the food and beverage industry. Alternatives to dairy, Greek yogurt, free-from foods, plant-based protein suitable for a vegan diet, etc. have mostly been brought on by smaller companies or entrepreneurs. It’s therefore essential for food and beverage giants to correctly interpret their market data, and accurately predict the coming market trends that are here to stay.

Key TakeawaysBig food and beverage companies and smaller businesses alike need to watch for industry insights and anticipate market trends. Staying true to your brand is more important than ever, as that prevents consumer confusion or disappointment. However, it’s even more crucial to adapt to the changes in the industry and the growing market demand for healthier food and drink options.

Retail & Grocery: Amazon.com, Inc.

In only 24 years, Amazon.com Inc. has evolved from a little online bookstore to the most extensive digital retailer in the world. Generating $177.9 billion in net sales from its over 300 million users in 2017, it is a giant in many markets, including retail and groceries.

As the company remains true to its four guiding principles – customer obsession rather than competitor focus, passion for invention, commitment to operational excellence, and long-term thinking – its sell-through position strengthened with inroads in new categories. Among other things, it has led Amazon to acquire Whole Foods Market as its subsidiary.

In 2018, the growth trend continues. Despite demanding more dollars for marketing from vendors, Amazon has met planned sales expectations for the second quarter for many categories (14 out of 25), exceeding plans in 9 categories in the changing natural food industry.

Orders from Whole Foods mainly surpassed its planned expectations due to deep discounts for Amazon Prime members, while higher marketing fees discouraged vendors from investing in promotion for their products. As a result, more vendors have opened Seller Central accounts, which allowed them to manage costs better and simplify product launch, and increased direct shipment from Prime Now.

Those are only two critical areas to watch. But if you want to learn more about other changes in 2018, there are other trends to look out for in retail and grocery as the year draws to an end at Amazon.

A Growing Amazon Prime Membership

In May 2018, the cost of Amazon Prime membership rose to $119. And while some vendors viewed it negatively, most don’t expect any significant impact on service use. It comes down to the advanced features included in the membership to its users, including Amazon’s marketing tools and expanded offering on Amazon.com platform. A natural food vendor even said:

“Amazon keeps offering more and more benefits [for Prime members], so I don’t think [the higher annual fee] will have any impact. Prime members value that service so much.”

And payment fees and commissions to Amazon were also raised in most vendor contracts. Because of the 10% increase in rates, all vendor contracts from 2017 are invalid, and sellers need to sign a new 2018 contract.

But it’s important to remember the terms in the new contract are negotiable. And while vendors do encounter additional fees, like fulfillment fees, inventory fees for storage, out-of-stock penalties, and accrual fees, it’s important to accept Amazon’s demands and negotiate a 2018 contract.

Amazon Competition Is Low

Amazon’s main competitors are Walmart.com and The Kroger Co., closely followed by Walmart’s Jet.com, Walmart brick-and-mortar stores, Target Corp. and Thrive Market Inc. However, most vendors agree that no e-commerce platform or store chain can compete with the retail giant when it comes to grocery retail.

However, Kroger and Target are making breakthroughs in grocery assortments and improving the shopping experience for their consumers. It seems to be generating interest among some vendors, as Kroger, for example, is placing standard category managers in charge of specific category managers and buyers. But it is yet to generate the amount of attention required to disrupt Amazon’s large-scale operation.

Amazon Prime Is Helping Whole Foods

Amazon’s Prime benefits (10% discount on all items and steep “Prime Member Deals”) helped increase sales during the second quarter in 2018 at Whole Foods Markets. The Amazon subsidiary saw an initial redemption rate between 60%-70% in June, but the figure is likely to reach 80% by year-end.

Prime Deals and promotion also aided vendors in their efforts. Many natural and organic vendors stated their Whole Food orders exceeded expectations, with almost all of them meeting their planned goals.

Despite this, vendors will bear the cost of those mandatory 10% discounts, which may result in several sellers reducing budgets allocated for promotion. However, for most of them, the price will be worth the effort if Amazon can deliver the right sales volume with Prime discounts. And according to the amount of sales Amazon made – it can.

Grocery Sales on Amazon.com and Fresh

In 2018, Amazon has made a lot of efforts to increase its foothold into groceries. It has led natural and organic food vendors to a very successful quarter with their sale of non-perishables on Amazon.com, than of perishable items sold on AmazonFresh. Also, over 65% of vendors exceeded planned order figures, which led some of them to improve their use of Amazon Marketing Services (AMS).

More and more vendors are turning to e-commerce SEO and search terms with AMS for marketing, than, for example, offering customer incentive programs such as coupons. On the other hand, vendor spending on ads has also increased but not significantly. Still, the combined efforts of both marketing tactics resulted in a higher revenue stream than in previous years.

In contrast, vendors who used AmazonFresh did not meet expectations. Their sales quotas fell below plan. They attribute this to significant reorganizations within the company, as AmazonFresh and Prime Now are hiring more staff in Seattle and distribution networks get realigned to handle perishable goods.

New Expansion Plans

Another critical factor influencing all of these changes is Amazon’s plan for rapid expansion. In short order, AmazonFresh is planned to move from the current eight-hour delivery format to a new two-hour delivery, which will make it stand out even more from the competition.

A new app is also set to be launched shortly, as Amazon wants to consolidate all of its grocery platforms in one place. But, until now, there is yet to be an integration of all purchases into one system, as Amazon.com, AmazonFresh, Prime Now, and Amazon Go remain separate from Whole Foods.

Finally, Amazon is moving towards direct shipments to reduce the reliance on United Natural Foods Inc. The plan is to allow room for rapid expansion of Prime Now with a hub-and-spoke system that will revamp warehouses and transportation logistics for perishables.

Follow Trends and News

Keep up to date with the latest innovations, trends, news, and so much more in the retail and food and beverage. Stay on top of best practices when it comes to marketing and sales, and gain insight from inside the industry.

With new developments each week, a piece of news, a new strategy or business model might catch your eye and lead you to apply it to your business to –

Seize the opportunity! Grow to scale! Realize the potential of your business! Become a leading influence on the market!

For more information about Cascadia Managing Brands, please go to www.cascadiamanagingbrands.com

Creating North America’s Premier Food Wholesaler

In June 2018, United Natural Foods (UNFI) and Supervalu decided to uproot North America’s wholesale distribution by combining their efforts to create a premier wholesale distributor. UNFI is the largest distributor of natural organic products in the United States and Canada, while Supervalu is the largest publicly traded wholesaler in the U.S.

Their joint enterprise indicates a rapidly changing infrastructure landscape in which consolidation among stakeholders in the supply chain is fast-becoming the new norm. And this has become a prime example of how manufacturers, suppliers, distributors, and retailers are pushing for change in Canada and the United States.

Based on this recent industry development, here are the most significant benefits of creating a premier food wholesaler in North America.

Adding Value to Customers and Stakeholders

Transforming into North America’s top wholesale food distributor is beneficial for all parties involved in the supply chain, including consumers and shareholders.

First off, it allows distributors to create a diversified consumer base. As they merge to form a common front, it automatically expands the consumer base to open up new opportunities to different stakeholders and increase distribution across all fronts. Delivering an extensive and comprehensive product offer to UNFI’s existing natural and organic products has allowed Supervalu to create a genuinely “better for you” offer.

As high-value products like organic meat and products become available to a broader audience, it enables cross-selling opportunities for different stakeholders on a much larger scale. A much more significant market across the United States and Canada gives wholesalers a much broader geographical location to work with and increase their market reach. The much more extensive scale has not only enabled growth but has improved their efficiency and effectiveness across the board.

The increase in capacity relies heavily on leveraging scalable systems. Focusing attention on streamlining larger operations has enabled different stakeholders to optimize their processes. Combined with the increased use of technology to achieve this goal has equipped all involved parties to meet customer expectations and reduce future expenses at the same time.

And in the case of UNFI and Supervalu, it also delivers significant synergy, which by the third year can create a run rate cost opportunity of more than $175 million.

Advanced Build-Out-The-Store Growth Strategy

With UNFI and Supervalu heading the enterprise, many smaller brands have joined the food super-wholesaler. Both giants contributed in equal measure in securing brands which create the supply chain. UNFI brought Blue Marble Brands, Woodstock Farms, Tumaro’s, Rising Moon, and Field Day to the fold, while Supervalu contributed with Essential Everyday, Culinary Circle, Market Centre, and Wild Harvest, among others.

Handing each brand a seat at the table has enabled them to have a united market presence, and create an advanced build-out-the-store growth model. The strategy is relatively simple and relies on increasing the product range to bring in attractive products to the store, and build a comprehensive and diversified product portfolio.

With each brand specializing in a specific food group, everyone is specializing in premier products. It expands the offer to the consumer, who is treated to a variety of quality, natural, organic, free-range, and specialty food items.

Complementary Contribution

Combining the two wholesalers into one has also merged their capabilities. It works because both UNFI and Supervalu share certain features. However, their most significant advantage is in the different and unique abilities, which essentially compliment one another.

UNFI’s revenue contribution is divided among Independent Natural Retailers (26%), Supermarkets (30%), Supernatural Retailers (33%), and other revenue (11%) such as e-commerce retailers and foodservice customers.

Supervalu’s revenue contribution is divided among Independent Regional Supermarkets (61%), Unified Groceries (29%), SVU FL (5%; regional chains, multi-stores, and single stores), and other (5%) which includes military and corporate revenue.

The combined revenue of UNFI and Supervalu is therefore divided among Independent Regional Supermarkets (48%), Unified Groceries (17%), Supernatural Retailers (14%), Independent Natural Retailers (11%), other revenue (8%), and revenue from SVU FL (3%).

It diversifies the consumer base for both wholesale retailers, as well as their revenue streams. In doing so, both UNFI and Supervalu can adapt to the fast growth of retailers and supply their demand for products.

A Compelling Opportunity

The opportunity for the premier food wholesaler will be to unlock the potential value across the business using synergy. Synergetic cooperation between the two organizations will improve the business process and inside operations, but also create a unified presence when dealing with outside services.

A combined effort has a more significant effect than individually either UNFI or Supervalu would have ever been able to achieve, and will benefit multiple aspects of the premier food wholesaler:

- Revenue – a diversified revenue stream from cross-selling, offering high-growth products in stores and expanding the private label offering (net sales expected to reach over $21 billion);

- Capital expenditure – increasing optimization of the supply chain and more effective capacities in distribution centers minimizes costs and expenditure (strong cash flow can reduce leverage and improve the credit profile);

- Systems and technology – combining IT systems and cyberinfrastructure of both companies will enhance automation and use of technology to streamline the business process;

- Operations – joint operations, increased capacity and a united strategy all increase efficiency inside the business model and stood to benefit everyone across the supply chain;

- SG&A (selling, general & administrative expenses) – increased capacity minimizes expenses especially by optimizing lease contracts and reducing fleet-related costs;

- Expanding Gross Margin – aligning strategies and methods of inbound logistics and adopting a professional service unit to monitor the process will help with larger capacity.

Ready to Learn More About the Food and Beverage Industry?

Stay up to date with the latest news and innovations in the food and beverage industry, and use what you learn to grow your business. It’s the best thing you can do for your brand, and all you have to do is realize the opportunity right in front of you to use its potential. Contact me or connect on twitter if you want to share with me your industry experience.

For more information about Cascadia Managing Brands go to www.cascadiamanagingbrands.com